Favorable Interest Rate Environment Boosts JPMorgan

JPMorgan Chase’s (NYSE:JPM) results for the third quarter of the year, announced on Thursday October 12, painted a largely positive picture of the banking industry over the period and gave investors a good idea of what to expect from other banks’ earnings figures over the coming weeks. The key trends that helped JPMorgan’s results were notable gains to the bank’s net interest margin figure from the Fed’s rate hikes, strong inflows into its asset management unit and continued growth for its commercial lending unit – especially in commercial real estate lending. The resulting consumer banking, asset management and commercial banking revenues mitigated the impact of poor debt trading revenues, as well as weak mortgage banking revenues, on the top line to a large extent.

The third quarter was a notable one for JPMorgan also because the bank moved past rival Bank of America over the period to become the biggest bank in the country in terms of total deposits. JPMorgan is already the largest U.S. bank in terms of total assets as well as market capitalization, and now the only remaining milestone for the bank is that of being the largest in terms of total loans (where Wells Fargo and Bank of America rank #1 and #2, respectively).

JPMorgan’s market leading position across banking services will continue to drive the bank’s profits in the long run. We maintain a $98 price estimate for JPMorgan’s stock – a figure that is slightly ahead of the current market price.

See our full analysis of JPMorgan

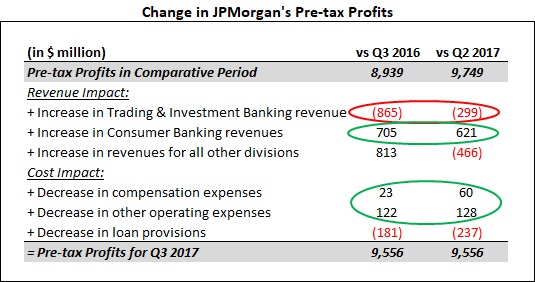

The table above summarizes the factors that aided JPMorgan’s pre-tax profit figure for Q3 2017 compared to the figures in Q3 2016 and Q2 2017. Trading & Investment Banking revenues fell considerably y-o-y, and were also below the already weak figure for the previous quarter. The primary reason for this was a reduction in global debt trading activity for the period. However, these losses were largely mitigated by a strong Consumer Banking performance thanks to rebounding interest revenues and improved card fees. While revenues from all other divisions also saw sharp improvements compared to the year-ago period, the sequential reduction here can be attributed to the one-time cash gain for the bank from a legal settlement in the previous quarter. Adjusting for this, the bank’s record commercial banking and asset management performance led to notable top-line gains this time around.

JPMorgan also did well to report a reduction in operating costs compared to Q2 2017 and Q3 2016. While the lower compensation figure can be explained by lower performance-related payouts for the investment banking arm, the improvement in non-compensation expenses are due to lower general and administrative expenses. Loan provisions were noticeably elevated for Q3 2017, but this was largely expected given the fact that card loan charge-off rates are normalizing from the record lows they were at a couple of years ago. We believe that the normalization will continue to drive card provisions higher over coming quarters before the figure settles down.

Net Interest Revenues Now Fully Reflect The Fed’s Rate Hike

JPMorgan’s net interest income accounts for between 45-50% of the bank’s total revenues for any given quarter, which is why even slight changes to the bank’s net interest margin (NIM) figure have an amplified effect on its earnings. The benefits of the Fed’s rate hikes began to reflect across JPMorgan’s businesses in Q1 2017 thanks to the bank’s sizable custody banking division which gained immediately from the Fed’s rate hike. But the NIM figure shrank in Q2 before increasing in Q3 to the highest level since Q1 2013. Coupled with the steady growth in JPMorgan’s interest-earning assets, this resulted in net interest revenues increasing to almost $12.8 billion – the highest ever for the bank after the unusually high figure of $13.7 billion reported in Q1 2010.

The table above summarizes how changes in NIM and the interest-earning asset base have affected JPMorgan’s net interest revenues (fully-taxable equivalent basis) in Q3 2017. As seen here, interest revenues gained for the quarter from both higher NIM figures as well as higher interest-earning assets. The NIM figure for the quarter (2.37%) was well above that for Q2 2017 (2.31%) as well as Q3 2016 (2.24%). It should be noted that the Fed intends to continue its rate hike process over subsequent quarters. While the interest rate environment is expected to remain in a state of flux while the process is underway, interest rates should eventually normalize – leading to sizable gains for all banks.

You can see how a change in JPMorgan’s net interest yield on consumer loans affects our estimate for its share price by modifying the chart below.

The Investment Banking Division Had An Overall Poor Run In Q3

After having an exceptionally strong run over Q2 2016 – Q1 2017, JPMorgan’s FICC (fixed income, currency and commodities) trading desk turned out two mediocre performance over Q2 2017 as well as Q3 2017, as low volatility in debt markets globally depressed the demand for debt trading services. In fact, September 2017 witnessed the lowest volatility index figures on record – something that hurt revenues across the industry.

The table below details the changes in JPMorgan’s investment banking revenues for Q3 2017 compared to Q3 2016 and Q2 2017.

As can be seen here, nearly all of JPMorgan’s investment banking units fared worse this time around compared to Q2 2017 and Q3 2016. The M&A advisory unit stands out with small gains over comparative periods, but this was hardly enough to mitigate the declines from other units. Interestingly, JPMorgan’s equity trading revenues nudged lower despite the ongoing rally in global equity markets. This can also be attributed to low market volatility. That said, the bank would have booked sizable mark-to-market gains due to elevated market valuations – without which the revenue figure would have been much lower.

Commercial Banking, Asset Management Divisions Stepped Up To Fill The Gap

JPMorgan’s commercial banking division churned out record revenues and profits, as the bank’s commercial loan portfolio grew to above $200 billion for the first time. This helped the division’s interest revenues, even as lower-than-expected charge-off rates allowed JPMorgan to release some of its loan reserves.

At the same time, JPMorgan’s asset and wealth management (AWM) business also saw profits reach a new high on the back of record assets under management (AUM). Total AUM swelled to $1.945 trillion at the end of Q3 – up from $1.77 trillion a year ago thanks to a combination of strong inflows as well as improved market valuation of securities. Taken together with other custody and brokerage assets, this helped the division’s total client assets reach an unprecedented $2.68 trillion.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research