What To Expect From Johnson & Johnson’s Q1?

Johnson & Johnson (NYSE:JNJ) is expected to publish its Q1 2019 results on April 16. This note details Trefis’ forecasts for Johnson & Johnson, as well as some of the key trends we will be watching when the company reports earnings.

What To Expect From Johnson & Johnson In Q1

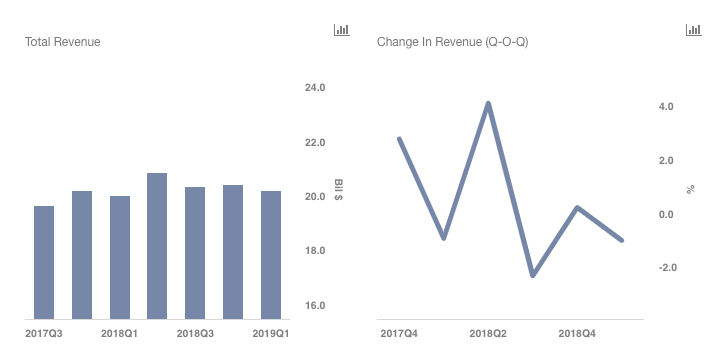

- Expect total revenues to remain flat year-over-year at around $20 billion.

- Adjusted earnings could fall slightly to under $2 per share.

What Trends Will Drive The Company’s Performance?

- While Consumer business is expected to grow, it could be offset by lower Medical Devices sales, given the divestitures.

- Pharmaceuticals will likely remain flat year-over-year, as the company faces biosimilar headwinds for some of its drugs.

- The company recently agreed to settle all Xarelto related lawsuits, and this should push the litigation expenses higher in the coming quarters.

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Here’s What To Expect From Johnson & Johnson’s Q1

- What’s Next For Johnson & Johnson Stock After A 6% Decline In A Month?

- Is Johnson & Johnson Stock A Better Pick Over AbbVie?

- Will Johnson & Johnson Stock Rebound To Its Pre-Inflation Shock Highs of $185?

- Should You Pick Johnson & Johnson Stock At $160?

Why Are Pharmaceuticals Sales Expected To Remain Flat?

- Expected double-digit decline in Remicade and Zytiga sales, which have now lost patent exclusivity.

- This will mostly be offset by continued growth in Imbruvica, Darzalex, and Tremfya.

- Remicade and Zytiga sales in 2018 ~ $8.5 billion.

- The company has taken price cuts to maintain Remicade’s leadership position in the infliximab market.

- However, the generic competition will likely have a meaningful impact on the drug sales in the coming quarters.

- Remicade market share as of Q4 2018 ~ 93%.

- Imbruvica and Darzalex are seeing growth across multiple indications, and this trend will likely continue in Q1 as well.

What To Expect From Other Segments?

- Medical Devices segment revenues will likely see a modest decline in Q1, as growth in Vision Care and Interventional Solutions will be offset by Diabetes Care, given the divestiture of the LifeScan unit.

- Consumer Healthcare could see mid-high single-digit sales growth, led by Baby Care, given its relaunch in the U.S.

You can view our interactive dashboard analysis on ~ How Is Johnson & Johnson Likely To Have Fared In Q1? for more details on the key drivers of the company’s Q1 performance. In addition, you can see more of our data for Healthcare companies here.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.