Intuitive Surgical’s Revenue Growth Could Slow?

Intuitive Surgical (NASDAQ:ISRG) generates its revenues primarily from sales of robotic surgical systems, and its related accessories & services. While the revenues have grown at an average annual rate of 15% over the last 5 years, the pace could slow to 12% in the coming years, as the company will face direct competition from the likes of Mazor Robotics. In this note we discuss the revenue sources for Intuitive Surgical, its business model, historical performance, and expected growth of its segments. You can look at our interactive dashboard analysis ~ ISRG Revenues: How Does Intuitive Surgical Make Money? ~ for more details on the expected performance of the company. In addition, you can see more of our data for healthcare companies here.

Instruments & Accessories Account For Over Half of Intuitive Surgical’s Revenues.

- Instruments & Accessories sales includes EndoWrist devices, which have tools such as forceps and scissors attached to them, in order to provide better control to surgeons. Accessories include sterile drapes, camera heads, vision products, light guides, and other devices.

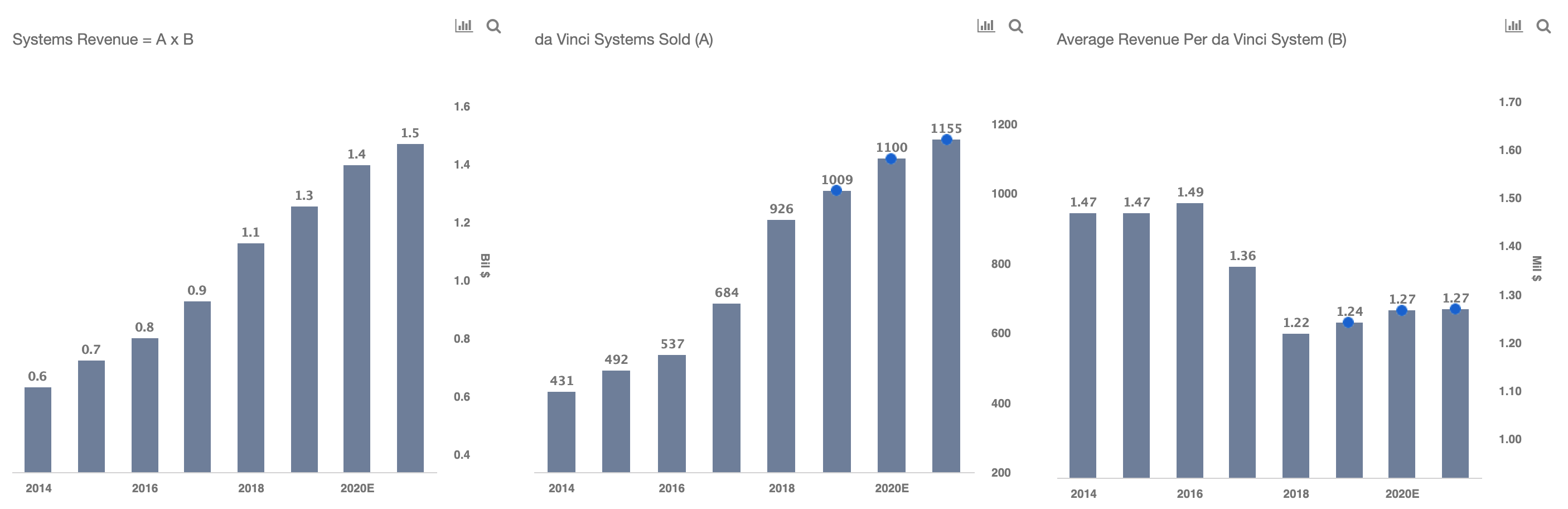

- Systems revenue refers to da Vinci surgical systems, which are computer assisted systems that help surgeons perform minimally invasive surgeries by controlling the device from a console.

- Services includes full-time support to its customers, from installing the surgical systems to repairing and maintaining them.

- Should You Pick Intuitive Surgical Stock At $370?

- Should You Pick Intuitive Surgical Stock At $375 After An Upbeat Q4?

- Is Intuitive Surgical Stock A Pick After A 9% Fall In A Month Amid Mixed Q3?

- Procedure Volume Growth To Drive Intuitive Surgical’s Q3

- With 2x Potential Returns Is DexCom A Better Pick Over Intuitive Surgical?

- Here’s What To Expect From Intuitive Surgical’s Q2

Intuitive Surgical’s Business Model

- What Need Does It Serve?

- Intuitive Surgical primarily serves the robotic surgical systems market. Its primary device is the da Vinci Surgical System, which helps surgeons perform minimally invasive surgeries through directions from a console. It delivers better postoperative results relative to traditional open surgery. The system is mostly used for prostatectomy and hysterectomy procedures.

- Intuitive Surgical has a significant patent portfolio and currently faces little direct competition in the robotic surgery market.

- Who Pays To Intuitive Surgical?

- Hospitals, surgeons, and healthcare institutions.

- What Buyers Care About?

- Cost of the device

- Technological innovation

- Quality

- Availability

- Government subsidy in the form of price controls

- Possible side effects

- Who Are Intuitive Surgical’s Key Competitors?

- SOFAR S.p.A.

- Meere Company

- Titan Medical

- Hitachi

- Olympus

- Mazor Robotics

- What Are Intuitive Surgical’s Competitive Advantages?

- Significant patent portfolio

- Huge R&D investments

- Limited direct competition

- High switching costs for the hospitals

Intuitive Surgical’s Revenue Growth Could Slow In The Coming Years

- Intuitive Surgical’s revenue growth pace has been on an upward trajectory, growing from 12% in 2015 to 19% in 2018.

- While the revenues are expected to continue to grow in double-digits in the near term, the pace could slow, as the company will face competition from Medtronic, which recently acquired Mazor Robotics, and the company has already secured the U.S. FDA approval for Mazor Stealth X System.

Instruments & Accessories Revenue Growth Has Been Led By Steady Volume And Pricing Gains, And This Trend Could Continue In The Coming Years.

- Instruments & Accessories revenues have grown from $1.1 billion in 2014 to $2.0 billion in 2018, and they could grow to $2.9 billion by 2021.

- This can be attributed to growth in both, the company’s installed base, and average annual instruments & accessories spend per unit.

- Total installed base grew from 3,266 units in 2014 to 4,986 units in 2018, and it could grow to north of 6,400 units by 2021.

- Average annual instrument & accessory spend per unit grew from $328K in 2014 to $394K in 2018, and it could grow to $448K by 2021.

- The growth will largely be led by procedures growth, which has been growing in double-digits of late. In fact, it was up 20% in Q3 2019, and it is expected to be up 18% y-o-y for the full year 2019.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.