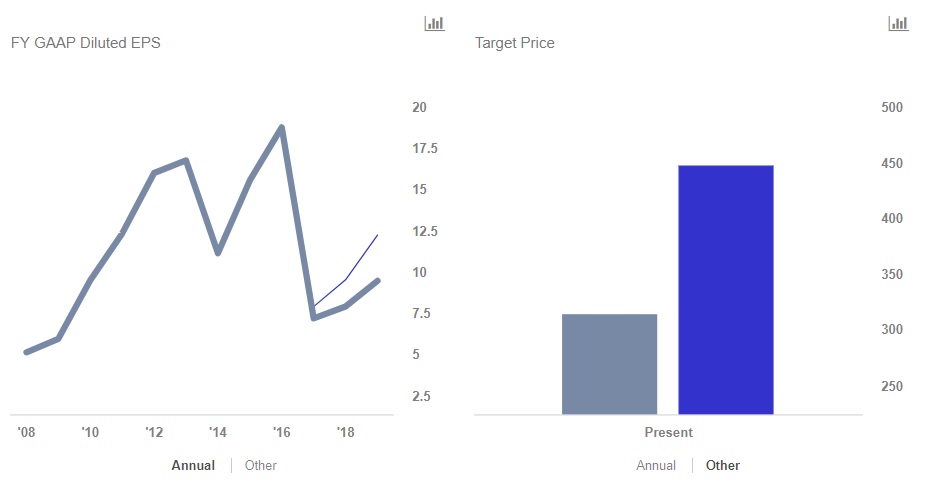

How Intuitive Surgical Can Be A $450 Stock?

Intuitive Surgical’s (NASDAQ:JNJ) stock saw strong gains in 2017, increasing by more than 70%. The investor optimism was fueled by the growth in the number of procedures and recurring revenue streams. The obvious question that arises is – can the stock go up even further? We believe that any further gains will primarily depend on Intuitive surprising the market by the progress it makes in terms of expanding the adoption of its da Vinci Surgical Systems to a large number of surgical procedures. Take a look at our interactive breakdown of Intuitive Surgical’s business which shows how Intuitive Surgical can become a $450 stock. It is clear that selling more systems, while important, is not the sole answer. Intuitive’s future growth also depends on how strong its recurring revenue streams – such as sales of accessories and instruments – become. This, in turn, will depend on the utility of surgical systems across a large number of procedures.

How Intuitive Surgical Can Be A $450 Stock?

Intuitive surgical could become a $450 stock by 2019 if its GAAP EPS increases to $12.20 for 2019 instead of our current forecast of $9.45. This, in conjunction with our assumption that trailing-twelve month P/E at the end of 2019 will be around 37, which is Intuitive’s average for the last 5 years and a more reasonable assumption that the current high figure of 47, would imply that Intuitive’s stock price can hit $450. So what will intuitive need to do to achieve EPS of over $12? First, it will need to sell at least 15% more da Vinci Surgical System Units than our current forecast. Second, it will have to expand the utility of its installed base such that Average Instrument & Accessories Spend Per Average Installed Unit surges 30%-40% over our current forecast. This means a greater number of procedures per machine.

- Should You Pick Intuitive Surgical Stock At $375 After An Upbeat Q4?

- Is Intuitive Surgical Stock A Pick After A 9% Fall In A Month Amid Mixed Q3?

- Procedure Volume Growth To Drive Intuitive Surgical’s Q3

- With 2x Potential Returns Is DexCom A Better Pick Over Intuitive Surgical?

- Here’s What To Expect From Intuitive Surgical’s Q2

- Should You Buy Intuitive Surgical Stock Over MDT?

A 15% jump in annual da Vinci Surgical Systems Units Sold would imply an additional 90-100 units sold. With an expected average price tag of roughly $1.5 million, this will translate into additional $150 million in revenue. A 30%-40%% jump in our annual forecast for Intuitive Surgical’s Average Instrument & Accessories Spend Per Average Installed Unit would imply a figure of $550 instead of $400, resulting in incremental revenue of over $800 million given the expected installed base of over 5500 systems in 2019.

Our price estimate for Intuitive Surgical stands at $314, implying a discount to the market price.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)