Intel (NASDAQ:INTC) is set to report its Q2 2018 earnings on July 26, and we expect the company to post strong growth with low double digit revenue gains, primarily led by its Data Center Group. We also expect the company’s Client Computing Group to see low single digit revenue growth. Of late, the company has seen strong growth in its Data Center Group business, and we expect this trend to continue in the near term, and drive the earnings growth for the company. We have created an interactive dashboard ~ What Is The Outlook For Intel ~ on the company’s expected performance in 2018. You can adjust the revenue and margin drivers to see the impact on the company’s overall revenues, earnings, and price estimate.

Expect Data Center Group To Lead Earnings Growth

We forecast Intel’s Data Center Group revenues to grow in high single digits in 2018. The segment is benefiting from its cloud business, as well as high performance products, such as Xeon Scalable. Growth in cloud computing will result in greater sales of bigger, faster, and higher-end servers at the expense of cheaper ones, and the company will benefit from server virtualization. The company reported a 24% segment revenue growth and over 70% jump in operating income in the previous quarter, and the company will likely post double digit growth in Q2 as well. The segment margins have declined from over 62% in 2014 to 46% in 2016, due to higher expenses. However, the margins improved slightly to 50% in 2017, led by new improved process technology and higher average selling prices. We expect the margins to remain around current levels of 50% in the coming years, and any significant increase is unlikely.

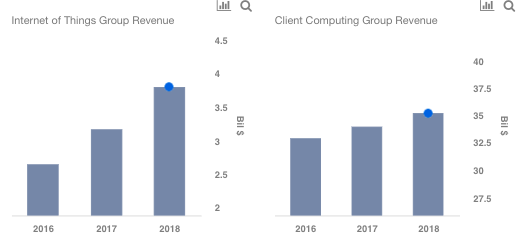

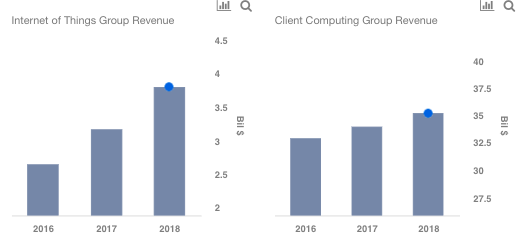

Among other segments, the Internet of Things has seen revenue growth at a CAGR of 15% over the last 5 years, and we expect it to grow at a even higher pace in the coming years. The market is expected to expand, and Intel has already made inroads, which should help its future growth. In fact, the installed base for Internet of Things devices is estimated to grow from around 10 billion connected devices in 2017 to as many as 30 billion devices by 2020. Looking at the Client Computing Group, the segment growth has slowed in the recent years, and we expect this trend to continue in the near term. This can be attributed to the trends in the overall PC market, which itself has

declined in low single digits in 2017, as well as in the previous quarter. However, Intel still managed to post 3% growth in segment revenues in the previous quarter. Our forecast of low single digit growth can be attributed to demand from emerging markets and launch of new form factors, which will likely help sustain notebook shipments. Also, the company recently launched its 8th Gen Intel Core i9 processor for mobile, which should aid the overall segment growth.

Overall, we expect the company to post adjusted earnings of $3.70 in 2018. We forecast a price to earnings multiple (TTM) of 14.5x, to arrive at

our price estimate of $53 for Intel, which is slightly above the current market price.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own.