What To Expect From IBM’s Q4 Earnings

Since IBM (NYSE:IBM) reported its Q3 earnings in October, the company has been in the news for both investments and divestitures. The company reports its Q4 on January 22, and we expect its operational results to show the impact of these portfolio readjustments – at least those which occurred early enough in the year to impact Q4 – with investors also focusing on the company’s long-term strategic direction and management’s view of technology evolution across cloud, edge, IoT, AI, blockchain and other emerging areas.

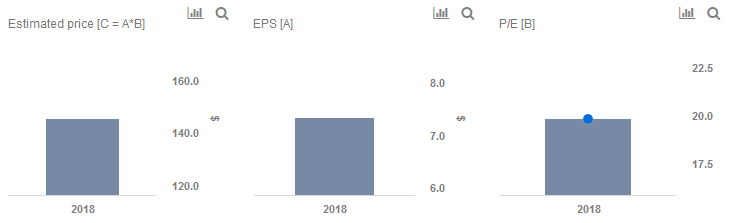

We currently have a price estimate of $146 per share for IBM, which is around 20% higher than the current market price. Our interactive dashboard on IBM’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Up 14% This Year, Will IBM’s Gains Continue Following Q1 Results?

- Up 17% This Year, Why Is IBM Stock Outperforming?

- Up 21% In The Last Six Months, Will IBM Stock See Further Gains Post Q4?

- IBM Stock Gains 10% Over The Last Month On Strong Earnings, AI Progress. What’s Next?

- With Stock Down 1% YTD, Will Lackluster IT Spending Impact IBM’s Q3 Results?

- How Will IBM Stock Trend Post Q2 Earnings?

While IBM’s Q3 may not have excited the markets, the company’s move to buy Red Hat for $34 billion took many by surprise. IBM believes that the leadership position of the combined entity in the massive and growing hybrid cloud market can help offset issues of weak growth as well as concerns around the funding of the pricey Red Hat deal.

In December, IBM again made headlines for its divestiture of certain software products to HCL for $1.8 billion. While many questioned the valuation that HCL was paying for technologies with a reported total addressable market of $50 billion, offloading IP where IBM and HCL already had partnerships could make sense for IBM’s longer-term evolution towards a cloud-centric play.

We will be watching out for any commentary on progress with the Red Hat deal closure, management color surrounding incremental business from the proposed combination, commentary around productizing Watson AI solutions in the combined hybrid cloud offerings, as well as the impact from incremental edge adoption and views on the evolution of the broader technology landscape.

Do not agree with our forecast? Create your own price forecast for IBM by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.