Is IBM Undervalued?

After shaking up the cloud market with its $34 billion acquisition of Red Hat, IBM (NYSE:IBM) has seen sideways movement in its stock. The market seems to be discounting the potential of the Red Hat deal, IBM’s focus on newer technologies and the company’s overall portfolio approach towards its various businesses.

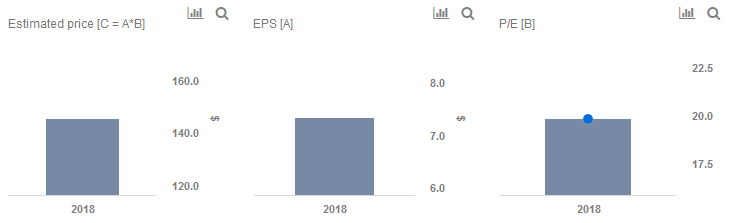

We currently have a price estimate of $146 per share for IBM, which is around 15% higher than the current market price. Our interactive dashboard on IBM’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Up 14% This Year, Will IBM’s Gains Continue Following Q1 Results?

- Up 17% This Year, Why Is IBM Stock Outperforming?

- Up 21% In The Last Six Months, Will IBM Stock See Further Gains Post Q4?

- IBM Stock Gains 10% Over The Last Month On Strong Earnings, AI Progress. What’s Next?

- With Stock Down 1% YTD, Will Lackluster IT Spending Impact IBM’s Q3 Results?

- How Will IBM Stock Trend Post Q2 Earnings?

In October, IBM’s stock fell from $150 to levels of around $120, at which the stock has largely remained since then. Post the Red Hat announcement, the stock has been fairly stagnant. In addition to the broader market sell-off, there could be a few reasons for the indecisive stock price movement, which we discuss below.

Impact From Red Hat

The growth in cloud adoption has led to several paradigms to enable use of data across diverse requirements, which has led to the concept of hybrid and multi-cloud architecture. This has led to increasing demand for middleware. While the Red Hat acquisition may not be sufficient for IBM to break into a leadership position in the cloud space alongside Amazon, Microsoft and Google, the acquisition is likely to help it achieve a strong position in the overall middleware space. IBM already has had a longstanding relationship with Red Hat, so exploiting many of the potential synergies should be fairly straightforward. Additionally, Linux (and especially Red Hat Linux) is increasingly becoming the operating system of choice. Further, Red Hat’s Openshift (middleware offering) is likely to drive growth in the cloud space. IBM believes that the overall impact of this growth could be a CAGR of 200 bps of incremental growth over the next five years.

Advances In AI, Blockchain

While IBM continues to scale AI across enterprise and consumer-grade applications, the company has also been able to ramp up blockchain usage for shipping and retailers. While the potential of these technologies is fairly large, IBM has stated that the potential within just shipping for blockchain could be as much as $30 billion.

Notwithstanding the recent divestiture of certain software assets to HCL for $1.8 billion, IBM’s strategy increasingly seems to be moving towards portfolio balancing to drive growth. Irrespective of the state of IT spending, integration of existing and new cloud resources is likely to become the new legacy work. Additionally, the company’s focus on incubating next-gen technologies while shedding non-core pieces should drive some longer-term upside for the company.

Do not agree with our forecast? Create your own price forecast for IBM by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.