What To Look Out For In HP’s Q4 Results

HP is scheduled to report its fiscal fourth quarter earnings on Thursday, November 29. The company’s Q3 numbers maintained the recent trend of beating consensus estimates, and unless the broader macro environment worsens significantly or a change in geopolitical math curbs growth, HP is likely to maintain the strong results moving forward.

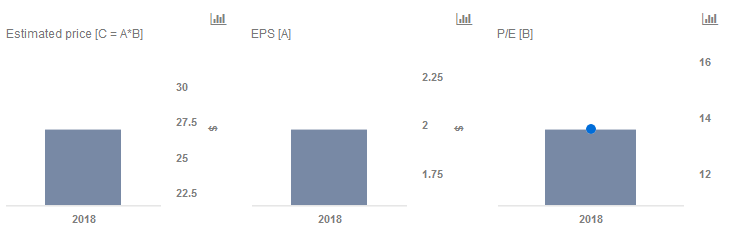

We currently have a price estimate of $27 per share for HP, which is around 20% higher than the current market price. Our interactive dashboard on HP’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Up 5% In A Fortnight, Can HP Inc. Stock Continue Outperforming The Market?

- What’s Next For HP Inc. Stock After Dropping 5% Last Week?

- Buy HP Inc. Stock For 25% Upside?

- Has HP Inc. Stock Peaked At $17?

- Here’s Why Hewlett-Packard’s Stock Could Touch $10

- Why Did HP’s Stock Price Grow 60% Between 2016 And 2018?

Recent Results And What To Watch For

HP has been able to improve its financial results on the back of management initiatives and an improvement in the PC market. As Windows 7 sunsets and Windows 10 becomes the new norm, HP appears to be confident about the slope of the ensuing ramp. However, on the printing business, there appear to be some challenges. HP’s acquisition of S-Print and the need to incubate a profitable installed base (across A3 and 3D printing) for contractual services are expected to continue presenting some margin pressure. That said, the strength in the PC business has been more than offsetting the weakness in the printing business. Going into Q4, we will be listening for color around:

- Continuing ASP strength in the PC business

- Buildup in inventory relative to demand

- Impact of tariffs from the U.S.-China trade disputes

- Commentary on impacts due to Brexit

- The net impact of the dollar strengthening and component price weakness on margins

HP believes that the way forward for the computing market is the ‘everything as a service’ contractual paradigm. The company appears to be leveraging the strength in its PC business to position itself as a major player in the new order, while maintaining shareholder returns.

Do not agree with our forecast? Create your own price forecast for HP by changing the base inputs (blue dots) on our interactive dashboard.