What To Expect From Honeywell’s Earnings

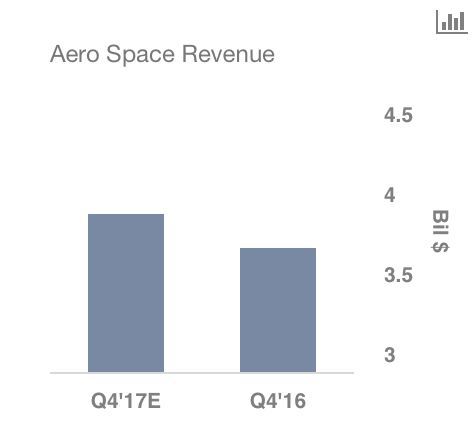

Honeywell International (NYSE: HON) has had a rather decent year thus far. The company started the year off strong, and kept that momentum running throughout 2017. While stagnant growth at Aerospace hurt the company’s top line, business at other segments helped offset the losses without much of a problem. Honeywell’s results throughout the year were buoyed by strategic investments, greater operational efficiencies, and stronger demand in most key markets. In this respect, the company felt comfortable enough to raise its guidance figures twice in the year. We expect the results in Q4 to carry forward a similar momentum.

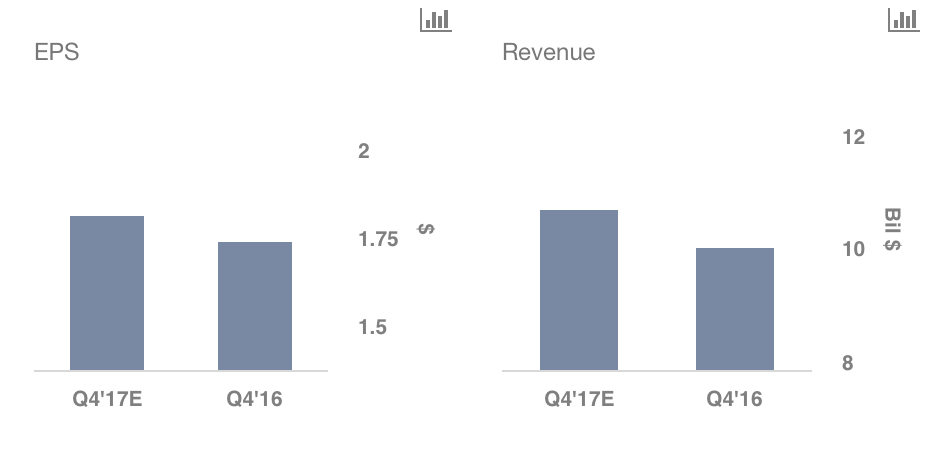

- In Q4, analysts expect Honeywell to take in an EPS of $1.84, which represents a growth of less than 6%, while sales growth is expected at around 7%. While there is a bit of margin contraction, investors should not worry. Any contraction is expected to only be a product of newer investments and/or acquisitions.

- Intelligrated is again expected to drive growth at Safety and Productivity Solutions. Coupled with higher demand for industrial safety products, Movilizer software sales, and better performance at voice-enabled workflow solutions, we expect the top line to benefit greatly in the quarter.

- Home and Building Technologies, Honeywell’s second largest division, has suffered in the past from lower margins. If the company is looking to greatly expand its margins in the coming quarters, it must make a change here. We can hope to learn more about this in the upcoming earnings call.

- Aerospace, and Performance Materials and Technologies (PMT) revenues have historically weighed on the overall top line. It will be interesting to see how these divisions end the year. While Aerospace showed some signs of improvement through Q3, which is expected to carry into Q4, PMT is yet to show signs of a reversal.

- Should You Pick Honeywell Stock After A 5% Fall This Year?

- Will Honeywell Stock See Higher Levels After A 15% Fall This Year?

- Which Is A Better Pick – Honeywell Stock Or Travelers?

- Which Is A Better Pick – Honeywell Stock Or Amgen?

- Which Is A Better Pick – Honeywell Or 3M Stock?

- Semiconductor Fab Equipment Companies, Like Lam Research, Are Outperforming. Will The Gains Continue?

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research