Why We Decreased Our Price Estimate For Harley-Davidson To $38 Per Share?

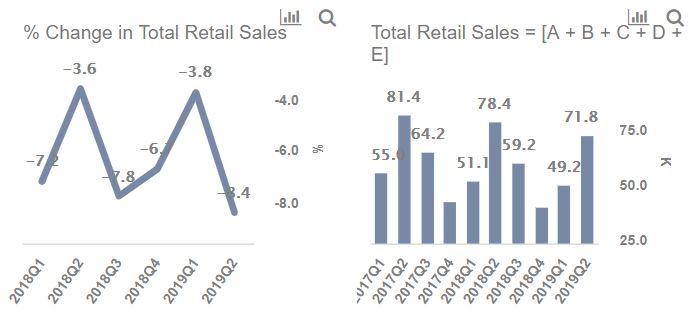

Trefis has further decreased its stock price estimate for Harley-Davidson (NYSE: HOG) from $39.22 to $37.55 in August 2019, amid the global automobile industry slowdown. The industry slowdown has affected Harley-Davidson’s sales volume along with multiple companies in the automobile industry. Sales volume has continuously decreased for all quarters when compared to the same quarter in the previous year. In Q2 2019 the sales volume fell by 8.4% (highest in the last 6 quarters). Annually, retail sales volume fell from 262.2K units in 2016 to 228.7K units in 2018. Trefis further reduced its estimate of the retail sales volume to 210.4K in 2019 as the overall industry sales weakened further.

View our interactive dashboard analysis on What is driving the price estimate of Harley-Davidson? You can modify our forecasts to arrive at your own estimates for the business. In addition, here is more Consumer Discretionary data.

- With Rate Cuts Around The Corner, Can Harley-Davidson Stock Recover To Over $50?

- Will Harley-Davidson Stock Return To Pre-Inflation Shock Highs?

- Can Harley-Davidson Stock Rise Over 50% To Pre-Inflation Shock Levels?

- What’s New With Harley-Davidson Stock?

- Harley-Davidson Stock Had A Stellar 2022. What Does 2023 Hold?

- What’s Happening With Harley-Davidson Stock?

Harley-Davidson’s Revenue and Forecast:

- Total Revenue decreased from $6 billion in 2017 to $5.7 billion in 2018 primarily due to motorcycle revenue. Trefis estimates it to be around $5.4 billion in 2019.

- The Heavyweight Motorcycle sales account for more than 60% of the company’s overall motorcycle sales. As a consequence of a decline in that market, the company is seeing a fall in motorcycle revenue. In Q1 2019 and Q2 2019 Harley saw a fall in sales volume by 3.8% y-o-y and 8.4% y-o-y, respectively.

- Annual retail sales volume fell from 262.2K units in 2016 to 228.7K units in 2018. Trefis estimates retail sales volume to be around 210.4K in 2019 as the overall industry sales are weak in the first 2 quarters of 2019.

- Motorcycle Revenue decreased from $5.3 billion in 2017 to $5 billion in 2018 as the fall in volume was partially offset by an increase in price. In 2019 we expect it to fall further to around $4.6 billion.

- Meanwhile, Financial Revenue increased from $725 million to $748 million due to an increase in segment assets partially offset by a decrease in interest rate. In 2019 we expect it to fall to around $740 million.

- Harley-Davidson’s profitability fell in 2017 to $522 million as indirect expenses remained flat but gross profit declined. In 2018 Net Income increased by 1.7% y-o-y as indirect expenses reduced as Harley focused more on operational efficiency, offset by the fall in gross margins due to higher material costs. Trefis estimates profitability to go down in 2019 because of lower sales revenue and an increase in raw materials cost.

We believe the automobile industry slowdown will continue in the near term and thus the sales volume of the company will remain low. Gross margins are also expected to fall due to higher material costs. Thus we reduced Harley-Davidson’s Valuation to $37.55 per share.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.