Tough Q4 2017 For Harley-Davidson, Strategic Focus To Grow Ridership Key Goal For 2018

Harley-Davidson (NYSE:HOG) announced its Q4 and full year 2017 results on January 30th 2018 reporting an EPS (earnings per share) of $0.05 which was much lower than the consensus expectation of $ 0.46. This figure was impacted by a one-time write down of net deferred tax assets due to the recent changes in the U.S. tax laws. The company’s revenues for Q4 2017 stood at $1.23 billion, higher than consensus estimates.

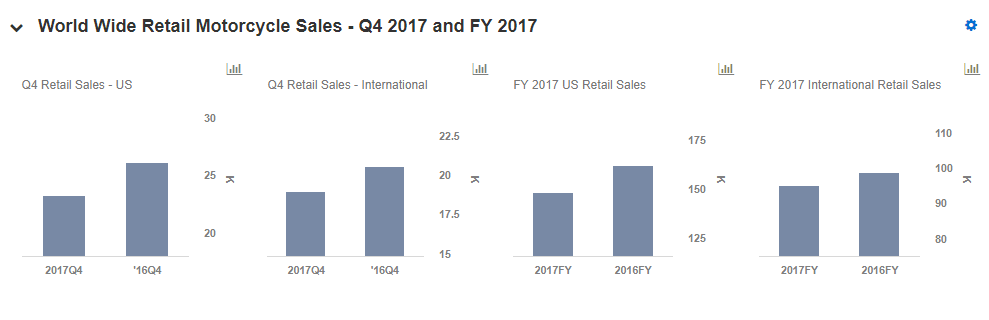

Q4 2017 was a tough quarter and the company ended 2017 on a challenging note. Worldwide retail sales declined by nearly 7% compared to the previous year – with an 8.5% decline in the U.S. and a nearly 4% decline in international markets. The silver lining to this challenging year was that the company added 32,000 new Harley-Davidson riders in the U.S. after taking several measures to create a more welcoming and all-inclusive brand. It has an ambitious target of adding 2 million riders in the U.S. in the next 10 years and the new additions in 2017 are higher than the average net additions required each year to meet this goal.

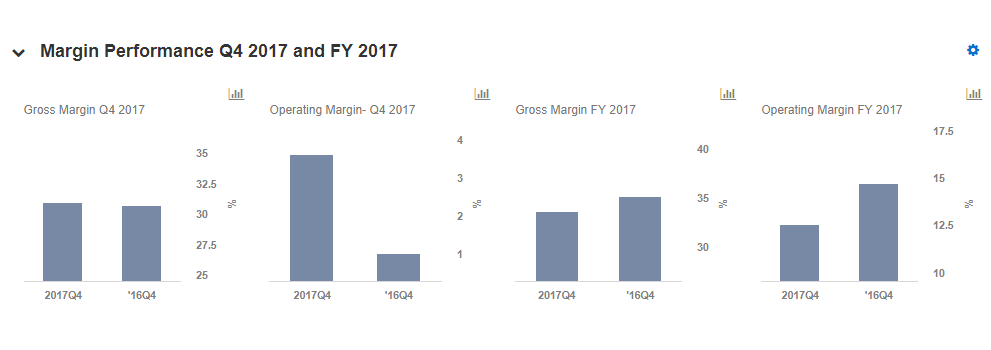

The below charts summarize the company’s performance in Q4 2017 and FY 2017:

- With Rate Cuts Around The Corner, Can Harley-Davidson Stock Recover To Over $50?

- Will Harley-Davidson Stock Return To Pre-Inflation Shock Highs?

- Can Harley-Davidson Stock Rise Over 50% To Pre-Inflation Shock Levels?

- What’s New With Harley-Davidson Stock?

- Harley-Davidson Stock Had A Stellar 2022. What Does 2023 Hold?

- What’s Happening With Harley-Davidson Stock?

You can click here to see our interactive model and access these charts.

Going Forward:

- Harley-Davidson expects headwinds in the U.S. to continue and is focusing on improving its cost structure to maintain margins in a tough environment. The company is optimizing its manufacturing facilities – beginning by consolidating its plant in Kansas and closing its wheel operations in Australia. This optimization initiative will lead to a reduction in operating income of $170 to $200 million through 2019 after which the company expects to see an ongoing cash savings of $65 to $75 million. Gross margins are likely to improve by 1.25 percentage points once this initiative is complete. Operating margin for 2018 is likely to be 9.5% to 10.5% – 2-3 percentage points lower than 2017.

- The company expects international retail growth in 2018 and will intensify its efforts to expand in these regions in 2018. Harley-Davidson will commence operations of its Thailand facility this year and this will enable the company to expand its dealership in Asia. Local manufacturing will also ensure competitive pricing as the products do not have to be subject to high import duties.

- In 2018, the company expects to ship 231,000 to 236,000 motorcycles, down by 2-4%.

- Harley-Davidson is looking to exploit the expanding Electric Vehicles (EV) market and “Project LiveWire,” the electric Harley-Davidson, has received encouraging feedback in the demo stage. This product is likely to be launched in the next 18 months.

We will be updating our model based on these results which can lead to a change in our price estimate for the company.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)