Key Takeaways From Honda Motors’ Q2 2018 Results

Honda Motors (NYSE:HMC) announced its Q2 2018 results on November 1st and the company reported a nearly 16% year on year increase in revenues driven by a sales increase and positive foreign currency translation effects. Operating profit declined by nearly 33% and the significant decline was due to a litigation settlement and the impact of pension accounting treatment during the same period last year. In Q2 2018 the company’s selling and general administration expenses witnessed a decline and the revenue and model mix impacted profitability positively. However, the litigation settlement was a drag on the operating profit.

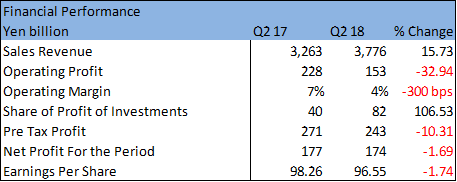

Based on these results, Honda Motors has revised its guidance for the fiscal year and now expects operating profits to be higher by 20 billion yen compared to the earlier guidance and revenues to be higher by 550 billion yen. Below is a summary of the company’s financial performance for Q2 2018:

Operating margin was lower this year due to the litigation settlement. Excluding the litigation settlement, the company would have achieved an operating margin of 5.5%.

While the company had indicated that operating margin might decline nearly 16% in fiscal year 2018, a better guidance indicates that Honda Motors is likely to perform better than expected in this fiscal year. The company’s production in the first half of the current fiscal year has been at record high levels, especially outside of Japan and it has revised its sales target upward for the rest of the year.

Below is a segment-wise summary for Honda group’s sales for Q2 2018:

Strong sales in the Motorcycles segment were driven by sales growth in India, Indonesia, and Vietnam. The increase in automobile sales was due to sales growth in Japan and China, offset by a decline in sales in North America. As expected, the company has performed strongly in China and improved its operating performance in Q2 2018, indicating that the rest of the year will be better than the earlier guidance.

Click here to see our complete analysis for Honda Motors, including revenue break-up from various divisions.

Our price estimate for Honda Motors is $29 and we may revise this price as we update our model based on these results.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research