Hartford’s Q3 Earnings Decline On Higher Catastrophe Losses

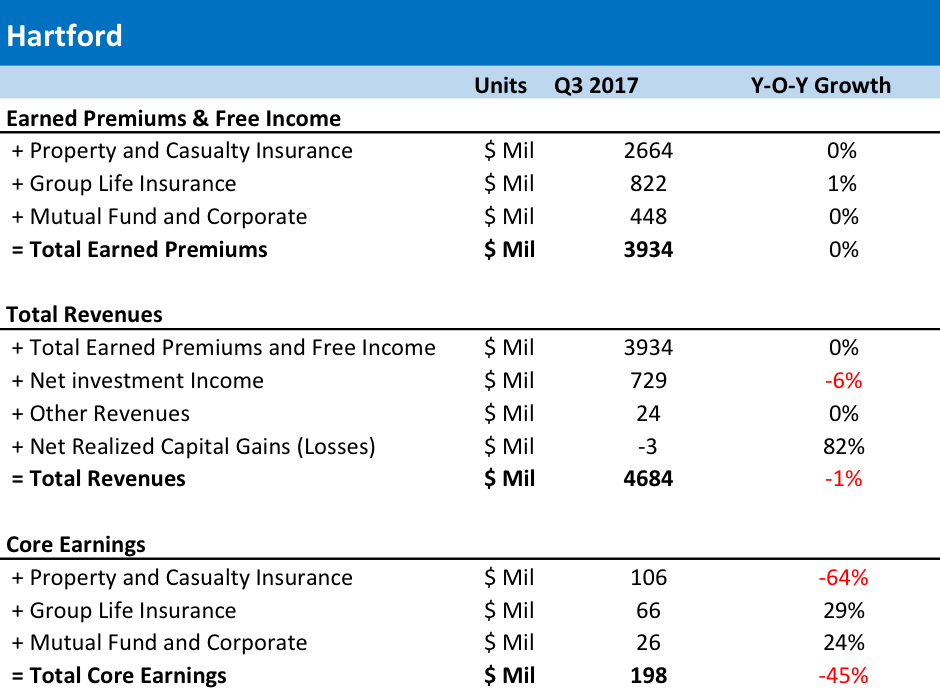

Hartford Financial (NYSE: HIG) reported its Q3 earnings on October 23, and its net income declined by almost $200 million year-on-year due to high catastrophe losses in the quarter. The property and casualty insurance segment earnings declined by nearly 65% in the quarter as catastrophe losses in the quarter totaled $353 million before taxes. However, the company delivered solid results in group life and mutual fund segment, where its core earnings grew by more than 25% in the quarter driven by lower group life and disability losses and growth in assets under management. In terms of the top line, the company’s total revenues of $4.68 billion were nearly 1% lower than the prior-year quarter in line with the consensus estimates.

Segment Results

- Up 19% YTD, What To Expect From Hartford Financial Stock?

- Hartford Financial Stock Lost 4% YTD, Is Correction In The Cards?

- Hartford Financial Stock Is Undervalued

- Is Hartford Financial Stock Fairly Priced?

- Hartford Financial Stock Lost 1.2% In One Week, What’s Next?

- Is Hartford Financial Stock Fairly Priced?

Hartford currently has three major sources of value – Property and Casualty insurance, Group Life insurance, and investments. The P&C insurance division contributes about 70% of the company’s revenues and 66% of its core earnings. Hartford has a 1.85% share in the U.S. P&C insurance market in terms of premiums earned, and offers both commercial and consumer insurance products. In the commercial segment, Hartford is the second largest player in the worker’s compensation space in the country, behind Travelers. The consumer P&C insurance division is comprised of personal automobile and homeowners’ multi-peril products.

In the third quarter, the company’s commercial lines income declined by nearly 66% due to high catastrophe losses caused by hurricanes Harvey, Irma and Maria. The combined ratio – the ratio of claims and expenses to premiums earned – also worsened by 14.7 points to about 108.6 in the quarter due to catastrophe losses.

As shown in the interactive chart below, we expect Hartford’s commercial lines combined ratio to stabilize around 91-92% by the end of our forecast period. However, if it remains at current levels of 95% owing to continued lower underwriting gains and higher catastrophe losses, there could be an 8-10% decline in the company’s valuation, per our estimates.

Hartford’s group benefits and mutual funds reported solid earnings this quarter, driven largely by favorable macroeconomic conditions in the U.S. We expect that improved macroeconomic conditions and the recent interest rate hikes by the Fed will boost Hartford’s group and mutual fund businesses in the coming quarters.

Have more questions about Hartford Financial? Please refer to our complete analysis for Hartford Financial

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap |More Trefis Research