What To Expect From Halliburton’s 4Q’16 Results?

Having exceeded market expectations by posting a notable earnings surprise in the last quarter, Halliburton (NYSE:HAL), the world’s second largest oilfield services company, is now slated to post strong results for its December quarter on 23rd January 2017, driven by the recovery in commodity prices over the last few months((Halliburton To Announce Fourth Quarter 2016 Results, 4th November 2016, www.halliburton.com)). The WTI crude oil prices shot up from an average of $44.85 per barrel in the September quarter to $49.21 per barrel in the December quarter, on the back of the Organization of Petroleum Exporting Countries’ (OPEC) decision to cut its cumulative production by 1.2 million barrels of oil per day (Mbpd).

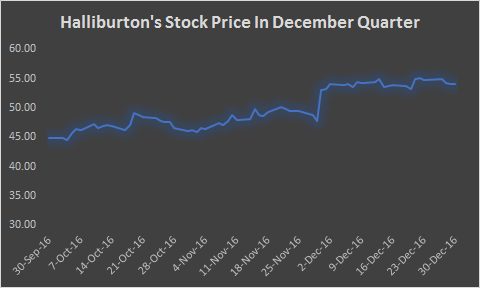

This was followed by a consistent improvement in the global rig count that bottomed out in the second quarter. The global rig count (oil and gas), which stood at 1,578 units at the end of the third quarter, grew sharply to roughly around 1,700 units at the end of the fourth quarter. Consequently, the oilfield contractor’s stock jumped more than 20% during the quarter, and ended the year almost 67% higher compared to the beginning of the year. While this sudden rise in the rig count will result in better profits and returns for the company in the coming quarters, the Houston-based company’s revenue for the December quarter is likely to remain low, due to the time lag between the recovery of commodity prices and the rise in demand for drilling rigs.

- What To Expect From Halliburton’s Q3 After Stock Up 10% This Year?

- What To Expect From Halliburton’s Stock?

- Can Halliburton Stock Return To Its Pre-Inflation Shock Highs?

- Halliburton Stock Likely To See Higher Levels Post Q1 Results

- What to Watch For In Halliburton’s Stock Post Q4?

- Halliburton Stock Up 14% Over Last Ten Days. What’s Next?

Source: Google Finance

Further, Halliburton has recently reached an agreement in principle to settle the claims related to an asbestos liability lawsuit filed against the company in 2003((Halliburton Reaches Settlement In Securities Class Action Lawsuit, 23rd December 2016, www.halliburton.com)). The company will fund roughly $54 million of the $100 million settlement fund for the lawsuit that has been pending in the US District Court for the Northern District of Texas for over 14 years. Assuming that the settlement will obtain the necessary approvals, the oilfield contractor will have a one-time charge on its books in the coming quarter(s) depending upon the timing of the settlement, which will have a marginal impact on its profitability.

Despite this, we believe that the Houston-based company is not shying away from competing with its peers to retain its market share in the industry. After Schlumberger‘s acquisition of Cameron in April 2016, and Baker Hughes‘ recent deal with GE’s oil and gas operations to form an industry leading oilfield provider, Halliburton too has announced a probable acquisition of an interest in Novomet Oil Services Holding Limited in order to expand its presence in the international artificial lift market((Halliburton Announces Regulatory Filing in Connection with Potential Acquisition, 23rd December 2016, www.halliburton.com)). The oilfield contractor is in talks with various shareholders of the company to discuss the terms of the deal and has filed the initial papers with the Federal Antimonopoly Service of Russia (FAS) to access the hindrances that the deal could face. However, nothing has been finalized yet and the deal will be subject to negotiation of terms, due diligence, regulatory approvals, and other legal conditions.

Overall, we believe that Halliburton will post another set of strong results in the current quarter, somewhat mitigating the impact of depressed commodity prices in the first half of the year.

Have more questions about Halliburton (NYSE:HAL)? See the links below:

- Halliburton 2016 In Review: All Is Well That Ends Well?

- Here’s Why Trefis Has Revised Halliburton’s Price Estimate To $49 Per Share

- Halliburton’s Positive 3Q’16 Results Bring Hope For The Oilfield Services Industry

- Schlumberger Versus Halliburton: Who Is Delivering Better Returns?

- Are The Commodity Markets On The Road To Recovery?

- How Will Halliburton’s Over Exposure To North American Markets Impact Its Profits?

- Halliburton Reports Depressed 2Q’16 Earnings Due To Persistently Low Drilling Demand

- Sluggish Drilling Demand Will Continue To Pull Down Halliburton’s 2Q’16 Results

- Halliburton’s 1Q’16 Earnings Plunge As Drilling Activity Remains Low, Particularly In North America

- How Will The Halliburton-Baker Hughes Deal Failure Impact Halliburton’s Equity Value?

- How Will The Halliburton-Baker Hughes Deal Impacted Halliburton’s Credit Capacity?

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for Halliburton Company

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap