Largest U.S. Investment Banks Made $10 Billion In M&A Advisory Fees In 2017, But Wallet Share Is Shrinking

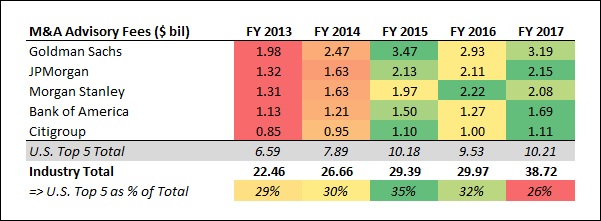

A surge in global M&A activity over 2017 helped advisory fees for the five largest U.S. investment banks jump to $10.2 billion for the year – up from $9.5 billion in 2016. In fact, the combined M&A advisory fees for these banks was the highest since the record-high level of $11.3 billion seen in 2007. However, the wallet share of these five banks has slid noticeably over recent years – falling from almost 35% in 2015 to just over 26% in 2017. This decline can be explained by the fact that M&A activity has increased sharply in developing nations (especially China) over recent years. While this has boosted global M&A advisory fees (which jumped to an all-time high of $38.7 billion in 2017), the U.S. investment banking giants haven’t been able to gain much ground in these fragmented markets where local players have a dominant share.

We capture the trends in M&A advisory fees for each of these investment banks over recent years in detail as a part of our interactive model, while also forecasting how this revenue is likely to change in 2018. We highlight key observations related to their M&A advisory fees below.

Goldman Remains The Global M&A Advisory Leader

- Trailing S&P500 By 18% Since The Start Of 2023, What To Expect From Goldman Sachs Stock?

- Down 12% In The Last Twelve Months, Where Is Goldman Sachs Stock Headed?

- What To Expect From Goldman Sachs Stock?

- Goldman Sachs Stock Is Undervalued At The Current Levels

- Goldman Sachs To Edge Past the Consensus In Q1

- Goldman Sachs Stock Is Trading Below Its Intrinsic Value

Of the $10.2 billion in total M&A advisory fees for the five largest U.S. investment banks, Goldman Sachs was responsible for almost $3.2 billion – representing more than 31% of the total figure. This compares to a share of around 20% for JPMorgan and Morgan Stanley, who ranked #2 and #3 respectively.

Total M&A advisory fees for the industry are taken from Thomson Reuters’ latest investment banking league tables. Notably, Goldman has held on to the top spot in terms of total annual M&A fees each year since at least 2005.

Reduction In Wallet Share For U.S. Banks

The chart below captures the total M&A advisory fees reported by the five largest U.S. investment banks since 2012. The green-to-red shading for figures along a row show the variations in these revenues for a particular bank over this period.

The global M&A advisory business has seen a sizable improvement in revenues over the last five years, but the U.S. banks have not been able to make the most of this growth as they had little role to play in some of the largest deals that completed over the quarter – primarily because they involved companies from developing countries like China.

Details about how changes to M&A Advisory Fees (and other Investment Banking Fees) affect the share price of these banks can be found in our interactive model for Goldman Sachs | JPMorgan | Morgan Stanley | Bank of America | Citigroup

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own