The Athleisure Trend: Is It Here To Stay?

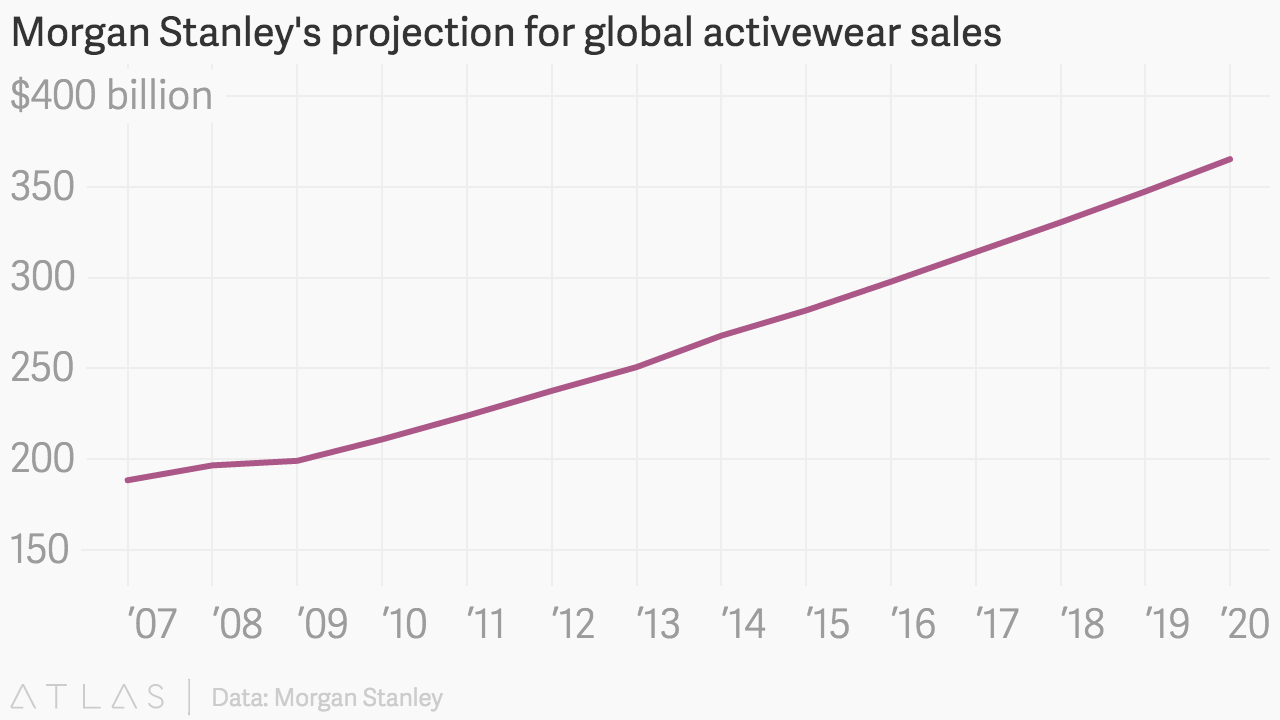

Activewear or the ‘Athleisure’ trend has become so popular, it has carved out a niche for itself in the clothing industry, and has won an entry into the Merriam-Webster dictionary, which defines it as “casual clothing meant to be worn both for exercising and for general use.” It has been the lone star in a waning apparel industry, with an estimated market size of $44 billion in the US alone, according to research firm NPD Group. While the apparel sales, as a whole, increased 2% year-on-year in 2015, the rise in activewear sales was a whopping 16%. If this category is excluded, the total clothing sales would have declined 2%, NPD stated. Morgan Stanley has predicted a growth to $83 billion by 2020, stealing the market share from non-athletic apparel. The graph below charts the rise of the trend globally, with sales climbing from $197 billion in 2007 to over $350 billion by 2020.

One of the reasons for the massive popularity of the athleisure trend is that it filled a gap in the market place, where clothing that was functional wasn’t particularly stylish. Such clothing can be worn to the gym, as well as everywhere else. This relaxed standard of clothing has been largely driven by the millennials, the largest demographic in the U.S. comprising 28% of the population. Their increased health consciousness, and a cultural shift in the workplace, has made it more acceptable to wear sneakers and sweatpants to the office. Furthermore, as per a Harris poll, 72% of millennials prefer to spend their money on experiences, rather than material things. As athleisure clothing is typically worn for an experience, more often an outdoor experience, such as working out or hiking, they are more likely to spend their money on it. Even for Gap Inc (NYSE:GPS), its Athleta brand, the company’s foray into athleisure, has been selling well. Strong sales of leggings and sports bras were a bright spot in otherwise dismal sales for the company in 2015.

However, as the market booms, there are questions on whether it is on the brink of saturation. A great run of activewear sales by companies such as Under Armour (NYSE:UA) and Lululemon Athletica (NASDAQ: LULU) has prompted the entry of everyone, from Kanye West and Stella McCartney partnering with Adidas, to Beyonce with Topshop, and Alexander Wang with H&M. Even discounters Wal-Mart and Target have entered the field, which has forced the prices to come down. The average prices of tights and capris dropped 9% in the first quarter of 2016, from a year prior, according to data from research firm SportsOneSource. This has also forced a 6% decline in the sales of these items, in dollar terms, in the first quarter.

A spate of bankruptcies also suggests the sports and athletic wear market can no longer sustain every retailer that does not stand out to the consumers. In the past year, bankruptcy filings have come from City Sports, Sports Authority, Pacific Sunwear, American Apparel, and Quicksilver. Since athleisure reflects a lifestyle shift, it is unlikely it will disappear soon, despite the market being over-stretched. The retailers will have to keep adapting, and this will mean using different materials, new features such as odorless fabrics, and keeping up to pace with the changing fashion trends.

Have more questions about Gap Inc? See the links below:

- Banana Republic Continues To Be A Drag On Gap Inc.

- How Is Gap Expected To Perform In 2016?

- Gap Reports Yet Another Month Of Declining Comparable Sales

- Can Old Navy Win The Back-To-School Market?

- What Are The Problems Plaguing Gap Inc.?

- Gap Reports A Weak Outlook For FY 2016

- Fall In Sales To Weigh On Gap In The Second Quarter

- After Positive Results In June, Gap Returns To A Sales Decline

- Are There Signs Of A Turnaround At Gap, Or Is It Just A Blip On The Radar?

- Are Gap Inc’s Earnings Volatile?

- What’s Gap Inc’s Revenue & Net Income Breakdown In Terms Of Different Brands?

- By How Much Did Gap Inc’s Revenue & EBITDA Grow In The Last Five Years?

- What Is Gap Inc’s Fundamental Value Based On Expected 2016 Results?

- By What Percentage Can Gap Inc’s Revenues Grow Over The Next Three Years?

- How Are Gap Inc’s Old Navy Revenues & Earnings Expected To Grow Over The Next Five Years?

- How Are Gap Inc’s Banana Republic Revenues & Earnings Expected To Grow Over The Next Five Years?

- How Much Revenues Can Gap Inc’s Athleta Brand Add By 2020?

Notes:

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap |More Trefis Research