Can Specialty Materials And Environmental Technologies Drive Growth For Corning In Q3?

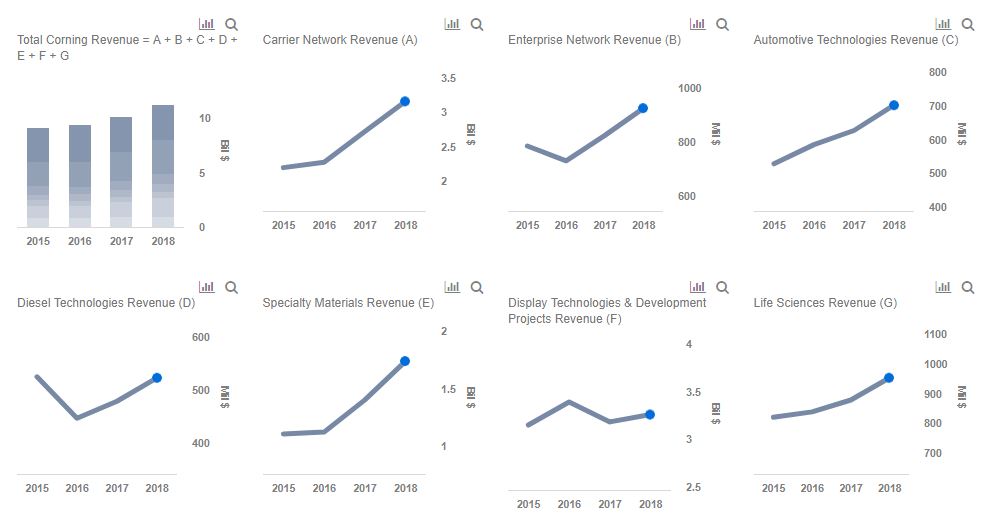

Corning (NASDAQ: GLW) is scheduled to announce its third quarter results on Tuesday, October 23. Consensus market estimates call for the company to report revenue of just over $3 billion and adjusted EPS of 49 cents. Optical Communications, which generates nearly 37% of the company’s revenues, grew by over 12% and drove most of Corning’s growth in the first half of 2018. The robust performance of this division was largely due to increased demand for its carrier and enterprise network products in North America and Europe.

Corning’s Environmental Technology segment, which generates slightly over 12% of the company’s total revenue, grew by about 19% as a result of strong demand for gas particulate filters, mainly due to greater demand for heavy-duty diesel products in North America and Europe. The Specialty Materials segment, which generates just under 12% of the company’s revenue, fell by nearly 7% as a result of lower than expected new phone launches in the first half of 2018 and increased development costs related to new technology. However, the anticipated launch of new smartphones should lead to improved demand for its products in the second half of 2018. We believe robust demand for its carrier and enterprise products, coupled with continued demand for its gas particulate filters, and new smartphone launches, should drive Q3 results. Below we take a look at what to expect when the company reports earnings.

Our price estimate for Corning’s stock stands at $31, which is slightly below with the market price. We have also created an interactive dashboard on Optical Communications, Specialty Materials, And Environmental Technologies Growth For Corning, which shows the forecast trends; you can modify the key value drivers to see how they impact the company’s revenues and bottom line.

Our price estimate for Corning’s stock stands at $31, which is slightly below with the market price. We have also created an interactive dashboard on Optical Communications, Specialty Materials, And Environmental Technologies Growth For Corning, which shows the forecast trends; you can modify the key value drivers to see how they impact the company’s revenues and bottom line.

- Should You Pick Corning Stock At $32 After Q4 Beat?

- What’s Next For Corning Stock After A 13% Fall In A Month?

- Which Is A Better Pick – Corning Stock Or West Pharmaceutical Services?

- Pricing Actions To Aid Corning’s Q2?

- Will Corning Stock Rebound To Its 2021 Highs of $45?

- Should You Pick Corning Stock Over Its Sector Peer?

Factors Driving Near-Term Growth

The Optical Communications division holds significant growth potential for Corning, as a result of the robust demand for its products across North America and Europe, coupled with strong growth in the amount of data being transmitted and processed. Consequently, we expect increased demand for its products by data center and carrier businesses. Corning is one of the leading players in the Optical Communications segment, and is well-positioned to expand its share over time. Additionally, the acquisition of 3M’s Communication Markets Division, which is expected to increase both its global reach and portfolio, should provide for moderate growth opportunities in the upcoming quarters and provide for meaningful long-term growth opportunities.

The Environmental Technology segment enjoyed a strong first half of 2018, as a result of improved demand for Corning’s gas particulate filters (GPFs). This was mainly driven by the sustained strength in the auto market in the U.S. and improvement of the heavy-duty truck market in North America and Europe. As a result, we expect strong demand for Corning’s gas particulate filters (GPFs) as auto OEMs ramp up for full adoption of EURO VI emission standards and as governments look to tighten emission standards. This should drive near-term growth in the Environmental Technologies division.

The Specialty Materials division had a mixed first half of 2018, as a result of lower than expected shipments of Gorilla Glass and higher development costs of new technology (Gorilla Glass 6). Further, the company also witnessed reasonable demand for its advanced optics products. The launch of three new iPhones, a strategic partnership with smartphone manufacturer OPPO, and the anticipated launch of several new smartphones later this year, should result in strong demand for Corning’s recently launched Gorilla Glass 6. In addition, increased use of glass backs on phones should further drive the segment’s revenue in the near term. Moreover, Samsung’s decision to use Gorilla Glass DX+ for its smartwatch should provide moderate near term growth opportunities. We expect this segment to grow driven by new smartphone launches, which should aid robust demand for its Gorilla Glass, thanks to increased adoption by smartphone OEMs.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.