Is Wabtec Paying The Right Price For GE’s Transportation Division?

General Electric (NASDAQ: GE) is on course to streamline its business as it announced its biggest divestiture yet. The company has reached an agreement to merge its transportation division, which mainly builds railroad locomotives, with rail equipment maker Wabtec (NASDAQ: WAB). Our valuation dashboard suggests that Wabtec is offering an attractive price from GE’s standpoint, despite the growth potential of GE’s Transportation business and the likelihood of realizing synergies. To understand its valuation better, we have created an interactive dashboard that shows how changes in its segment revenues, margins, and EBITDA multiple can impact GE’s Transportation valuation.

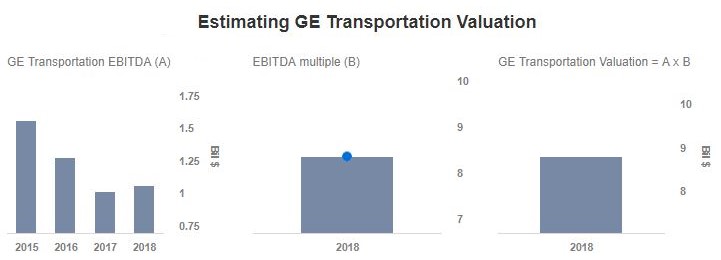

Our valuation estimate of nearly $9 billion is based on expected overall revenue of $4.2 billion in FY 2018 and an EBITDA multiple of 8.4x. We expect the Transportation division’s EBITDA margin to improve to 25.2%, from 24.7% in FY 2017, as a result of strong demand for new locomotives and modernization work of several locomotives. The 25% margin would imply EBITDA of just over $1 billion.

- What’s Next For General Electric Stock After A 35% Rise This Year?

- What’s Next For General Electric Stock After 70% Gains In A Year?

- Down 20% This Year Is RTX Stock A Better Pick Than General Electric?

- Should You Pick General Electric Stock At $110 After A Solid Q3?

- After An 18% Top-Line Growth In Q2 Will General Electric Stock Deliver Another Strong Quarter?

- Is General Electric Stock A Better Pick Over Its Sector Peer?

GE Transportation’s revenue for Q1’18 came in at $872 million (down 11% year-on-year), while the segment’s profits jumped nearly 15% largely due to a higher mix of service volume and lower engineering spend. However, we expect the trend of revenue declines to change in the near future. GE’s Transportation division received nearly $3.6 billion worth of orders in the last two quarters. In addition, the total order backlog for the division stands at approximately $18 billion. This is comprised of 1,800 new locomotives orders and modernization of 1,000 locomotives. As a result, we expect the Transportation EBITDA to come in at around $1.05 billion in 2018. Further, the modernization of nearly 11,400 locomotive units, coupled with the deal to upgrade and build new locomotives for Ukraine should provide significant long-term opportunity.