How Did GE Perform In Q1?

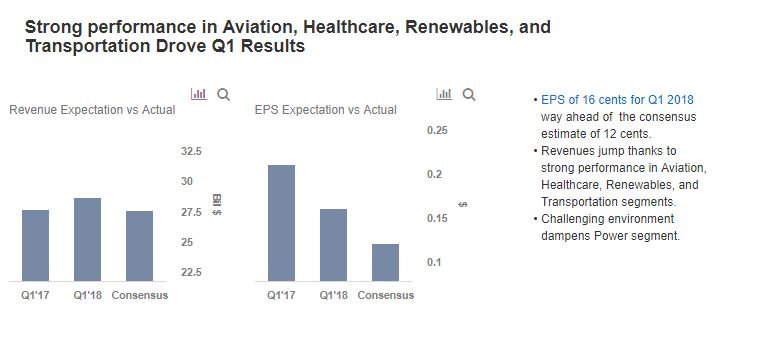

General Electric (NASDAQ: GE) reported better-than-expected its Q1 2018 results on Friday, beating both revenue and earnings consensus estimates. Revenues in the quarter came in about 7% higher than the year ago period, while earnings jumped by close to 14%. The better-than-expected results were driven by strong performance in the Aviation, Healthcare, Renewables, and Transportation segments and effective cost cutting techniques. The company’s turnaround could take some time, and will depend on an improving business environment and global growth, thus we expect GE to report mixed results in the next few quarters. Below, we provide a brief overview of the company’s results and what lies ahead.

We have created an interactive dashboard analysis which outlines our expectations for General Electric over 2018. You can modify the key drivers to arrive at your own price estimate for the company.

- What’s Next For General Electric Stock After A 35% Rise This Year?

- What’s Next For General Electric Stock After 70% Gains In A Year?

- Down 20% This Year Is RTX Stock A Better Pick Than General Electric?

- Should You Pick General Electric Stock At $110 After A Solid Q3?

- After An 18% Top-Line Growth In Q2 Will General Electric Stock Deliver Another Strong Quarter?

- Is General Electric Stock A Better Pick Over Its Sector Peer?

The Aviation and Healthcare segments were the top performers for the conglomerate in Q1’18, with revenue growing 7% and 9%, respectively, year-on-year. The Aviation segment enjoyed a strong Q1, as margins improved as a result of higher service revenue – commercial engines and aftermarket materials and cost efficiency. We expect the segment’s tailwinds to continue further into 2018 and drive segment revenue to nearly $28 billion (+ 4% y-o-y) driven by strong growth in the Military business, air freight volumes, and the delivery of 1200 LEAP engines by 2018 end. In addition, GE’s Additive and Digital business should provide long term growth opportunities. Meanwhile, the Healthcare segment enjoyed a strong Q1, driven by strong growth in emerging markets. On a product basis, ultrasound and imaging products experienced strong growth. We expect this trend to continue into 2018, driven by strong demand in emerging markets. In addition, the investment in FlexFactory platform – a semi automated cell therapy manufacturing process and the possible advancement of technology based smart healthcare should prove pivotal and provide for significant long term growth.

The market for high-end gas turbines has been fairly weak, largely due to the growth of renewable energy, and GE expects challenging power markets to continue into 2018. We expect the 2018 revenue in this segment to decline by nearly 4% to $33.8 billion.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own