What’s The Upside If First Solar’s Shipments, ASPs Surprise In 2018?

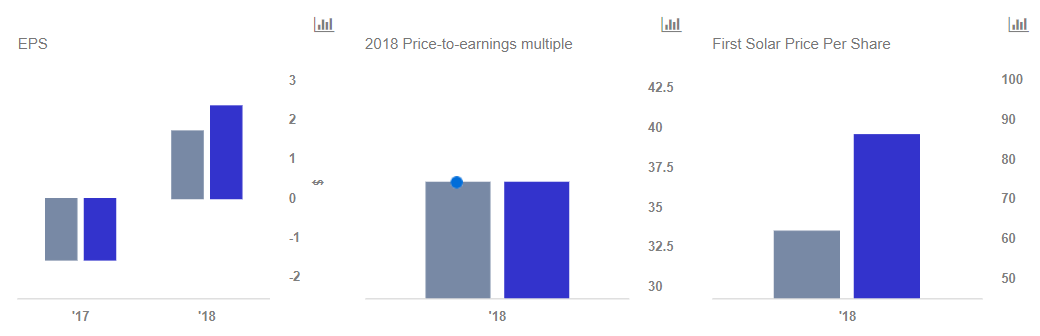

First Solar (NASDAQ:FSLR) is likely to have an eventful 2018. The company is currently transitioning from its Series 4 modules to its next-generation Series 6 modules, with its facilities in Ohio expected to begin high volume production from Q2. Although the transition could mean that the company will face a slight decline in shipments compared to 2017, it is likely to bring multiple long-term benefits, including lower panel production costs, higher efficiencies and more cost-effective deployment for customers. Separately, First Solar is also seeing some tailwinds from the imposition of import duties on silicon-based panels and cells, to which its Cd-Te based products are not subject. We have created an interactive dashboard analysis which outlines our expectations of the company in 2018. We have also created a scenario which outlines how the company’s value could increase by about 35% if it realizes stronger ASPs, shipments, and margins. You can modify our forecasts to arrive at your own estimates for First Solar’s EPS and valuation.

Shipments And ASPs

First Solar expects 2018 shipments to decline, as it transitions from Series 4 to next-gen Series 6 panels. Blended ASPs are also projected to trend lower, due to decline in panel prices. Our upside assumes that First Solar’s manages a faster than expected transition, with its panel prices also looking up due to the tariffs placed on Si-based panels.

- Down 6% This Year, What’s Happening With First Solar Stock?

- Down 17% In The Last Six Months, Will First Solar Stock Recover Post Q4 Results?

- Up A Mere 15% In 2023, Is First Solar Stock Poised To Do Better In 2024?

- Down 30% From Highs Seen In May 2023, Where Is First Solar Stock Headed?

- Why Is The Hydrogen Theme Underperforming This Year?

- Why This Renewables Theme Is Underperforming In A Strong Market

Gross Margins

First Solar’s gross margins are expected to expand to between 21.5% to 22.5% on a GAAP basis in 2018. However, stronger ASPs and a higher mix of lower-cost Series 6 panels could help to drive up margins even further, especially if shipments grow more than expected.

There Could Be 35% Valuation Upside If First Solar Beats Estimates.

Should this upside scenario come to fruition, with shipments and pricing improving more than we currently forecast, there could be an upside of around 35% to our price estimate for First Solar’s stock. Our base case price estimate of $58 is slightly below the current market price.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.