Why We Revised Our Price Estimate For Fox To $43

We recently revised our price estimate for 21st Century Fox (NYSE: FOX) upward to $43, which is still slightly below the current market price, on account of higher expected revenue and profit estimates relative to our previous forecasts. The company’s performance until now has been mostly above its guidance as well as market expectations. In fact, the company’s stock is now trading more than 20% higher than its price at the beginning of the year – though much of that has been driven by the potential sale of its assets, which we discuss below – and up more than 15% in the past year. Accordingly, we have adjusted our forecasts to reflect the current trends.

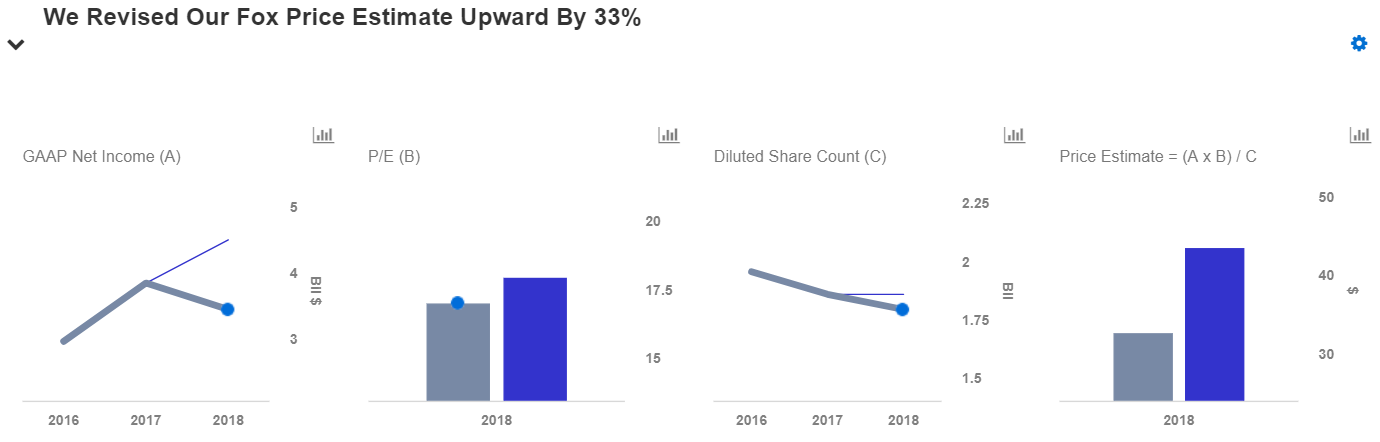

We have revised our net income estimate upward from $3.4 billion to $4.5 billion for the calendar year 2018, implying EPS of around $2.40. Further, we have also increased our trailing twelve-month P/E multiple for the company to 18 from a previous 17, which – when combined with the estimated EPS – gives us price estimate of $43. This is marginally below the current market price. Our interactive dashboard details our forecasts and estimates for the company. You can modify the interactive charts in this dashboard to gauge the impact that changes in key drivers for Fox can have on our price estimate for the company.

- Fox Stock Rallied 6% Last Week – What Should You Know?

- Fox Beats Q4 Estimates On The Back Of Gains In Cable Networks, Studio Performance

- U.S. Department of Justice Approves Disney-Fox Deal

- What Would A Potential Comcast-Fox Combination Look Like?

- How Much Could Comcast Benefit From Acquiring Fox’s Studio Business?

- Key Takeaways From Fox’s Q3 Earnings

Fox has largely benefited from gains at Cable Networks, driven by continued growth in both affiliate and advertising revenues in recent quarters. The company’s domestic affiliate revenues have been growing on higher pricing across its domestic cable brands, led by Fox News, FS1 and FX Networks, while the domestic advertising revenues witnessed a declining trend due to lower general entertainment ratings. In the March quarter, Fox News remained the most-viewed cable network in both primetime and total day and secured top ratings for the second consecutive year. To add to that, Fox’s international advertising revenues also continue to benefit from growth in STAR India. Aa result, we have increased our Cable Networks revenue forecast for 2018 by more than 5%. We also decreased our Film Entertainment revenue forecast from $8.8 billion to $8.4 billion in 2018, on the back of the costs related to the production of new drama series, lack of on-demand streaming revenues from series such as The People v. O.J. Simpson: American Crime Story and fewer theatrical releases in 2018.

We also decreased our 2018 estimate for Fox’s GAAP EBIT by $350 million to $6 billion, due to higher expected direct expenses and depreciation and amortization, and lower expected stock-based compensation costs. Overall, these adjustments have resulted in a more than 30% increase in our GAAP net income forecast.

Fox has had a very productive run over 2018, and the recent approval of the AT&T and Time Warner deal has opened up a bidding war for Fox’s assets between Disney and Comcast. Disney won the original bidding for the majority of Fox’s assets last December, with a $52.4B all-stock deal including Disney taking on $13.7 billion of Fox’s net debt, making the enterprise value of the deal $66.1 billion. However, Comcast has come up with a superior bid after the approval of the AT&T-TimeWarner deal, which includes a generous $65 billion all-cash bid, a $2.5 billion breakup fee if the deal fails, along with a $1.5 billion breakup fee to cancel the original Disney contract. We expect Disney to make at least one more strong bid in the near future, which could drive Fox’s stock even higher.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.