Key Takeaways From Fox’s Fiscal First Quarter Earnings

21st Century Fox (NYSE: FOX) reported better-than-expected fiscal first quarter results, as its earnings per share were in line and revenues came in ahead of market expectations. The company’s stock moved up slightly after the announcement. Below we highlight some of the most notable items from the earnings release.

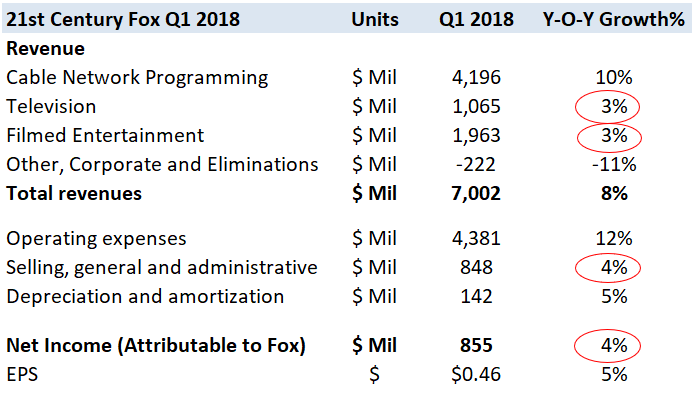

- The company’s overall revenue increased 8% year-over-year (y-0-y) to $7 billion, driven by gains across segments. This growth was led by higher affiliate revenues in Cable Networks and Television, as well as higher content revenues from the Filmed Entertainment business.

- On the cost side, the company’s operating expenses increased 12% y-o-y, primarily due to higher programming rights amortization at the Cable Network Programming and Television segments. Also, the company’s selling, general and administrative expenses increased 4% y-o-y, due to higher compensation expenses. From a bottom line perspective, Fox posted adjusted earnings of 49 cents per share, down 4% y-o-y.

- Fox Stock Rallied 6% Last Week – What Should You Know?

- Fox Beats Q4 Estimates On The Back Of Gains In Cable Networks, Studio Performance

- U.S. Department of Justice Approves Disney-Fox Deal

- What Would A Potential Comcast-Fox Combination Look Like?

- How Much Could Comcast Benefit From Acquiring Fox’s Studio Business?

- Why We Revised Our Price Estimate For Fox To $43

- Fox News remained the most-watched cable news network in the September quarter as well. However, the network was down 3% y-o-y in total day and declined 12% y-o-y in total viewers, due to a difficult comparison to Q1 2017 performance, which was dominated by the election. [1]

- In Q1, Fox’s Cable Networks revenues grew 10% y-o-y, and its EBITDA increased 9% over last year. The segment benefited from continued growth in both affiliate and advertising revenues, partially offset by an 11% y-o-y increase in expenses.

- Domestic affiliate revenues increased 11% y-o-y, driven by higher pricing across all of the domestic cable brands, led by Fox News, FS1 and FX Networks. While the domestic advertising revenues grew 3% y-o-y, led by higher ratings and pricing at sports channels. In addition, the segment’s international affiliate revenues grew 11% y-o-y, driven by higher rates and subscribers. Also, international advertising revenue increased 10% y-o-y from high double-digit advertising increases at STAR India.

- In Q1, Fox’s Television revenues grew 3% y-o-y, while its EBITDA fell 36% over last year. The segment was impacted by lower political advertising revenues at the TV stations and higher contractual sports programming costs at the FOX Broadcast Network, partially offset by higher retransmission consent revenues.

- Fox’s revenue at the Filmed Entertainment segment grew 3% y-o-y to 1.9 billion, primarily due to higher syndication revenue from television productions, partially offset by lower film studio pay and free TV licensing revenues. However, the segment’s EBITDA declined 18% y-o-y, driven by lower film studio revenues and higher production amortization and participation costs in the current year due to fewer theatrical releases versus last year. Fox studio grossed around $220 million in the September quarter at the U.S. box office, led by the release of War for the Planet of the Apes.

- In Q2 2017, Reuters’ compiled analyst estimates forecast revenues of $8 billion and earnings of 57 cents per share.

Our $32 price estimate for Fox’s stock is more than 15% ahead of the current market price.

Have more questions on 21st Century Fox? Please refer to our complete analysis for 21st Century Fox

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) Get Trefis Technology

Notes:- Q3 2017 Ratings: 15 Months at No. 1 for Fox News, Adweek, September 2017 [↩]