Forecast Of The Day: Freeport-McMoRan Average Realized Copper Price Per Pound

What?

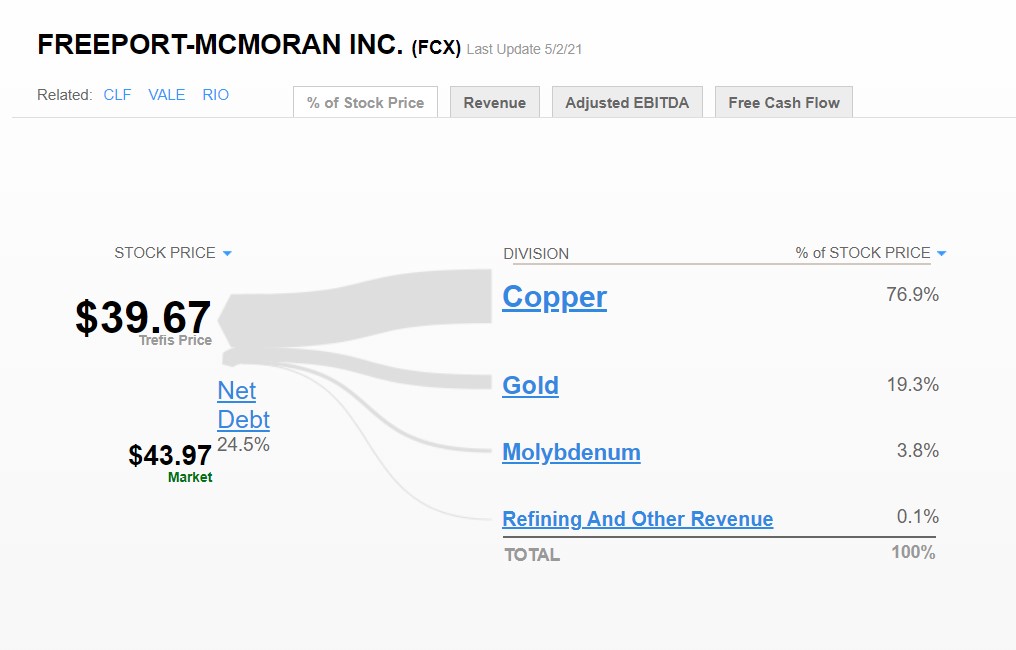

Copper prices have surged to all-time highs, with the metal trading at over $4.70 per pound as of Friday, up from just about $2.40 per pound a year ago. This is significantly positive for Freeport-McMoRan (NYSE: FCX) a major copper producer.

Why?

- Will Freeport Stock Recover To Pre-Inflation Shock Highs Of $52 Per Share?

- What To Expect From Freeport’s Q2 Results

- How Is Freeport Stock Faring Amid Volatile Copper Prices?

- Copper Prices Have Recovered A Bit. Is Freeport Stock Worth A Look?

- Lower Copper Prices Will Weigh On Freeport’s Q3 Results

- What’s Happening With Freeport-McMoRan Stock?

The gradual lifting of lockdowns, stimulus packages, and lower interest rates have led to expectations of faster economic recovery and higher demand from automobile and construction companies, leading to the copper rally.

So What?

Copper accounted for about half of Freeport’s Revenue in 2020, and its contribution is likely to grow meaningfully this year. Freeport stock is up by about 60% year-to-date driven largely by the copper rally.

Click here for the full Trefis coverage of Freeport-McMoRan

Looking for a balanced portfolio to invest in? Here’s a high-quality portfolio to beat the market, with over 150% return since 2016, versus 85% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams