Why Freeport’s Stock Has Disappointed Despite Higher Copper Prices This Year

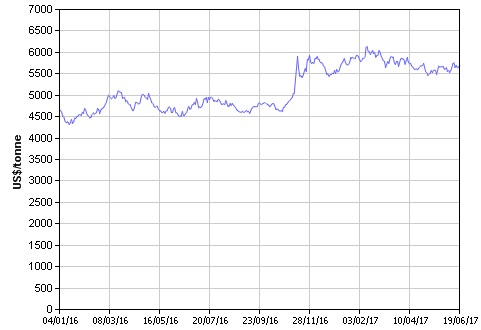

Activist investor Carl Icahn lowered his stake in Freeport-McMoRan to 6.33% earlier on in June from 7.2% in November of last year. [1] Mr. Icahn had upped his holding in Freeport-McMoRan to 8.8% in Q3 2015, and has trimmed his stake in the world’s second largest copper miner since then. [2] Copper prices currently stand around 20% higher than levels seen in the first ten months of last year (before the 2016 U.S. presidential election), as illustrated below.

LME Copper Prices, Source: LME

While copper prices are up, investor interest in Freeport has cooled considerably over the past few months, as evidenced by the decline in the company’s stock price and the news of Mr. Icahn lowering his holding in the company. In this article, we will look at the possible reasons for this.

- Will Freeport Stock Recover To Pre-Inflation Shock Highs Of $52 Per Share?

- What To Expect From Freeport’s Q2 Results

- How Is Freeport Stock Faring Amid Volatile Copper Prices?

- Copper Prices Have Recovered A Bit. Is Freeport Stock Worth A Look?

- Lower Copper Prices Will Weigh On Freeport’s Q3 Results

- What’s Happening With Freeport-McMoRan Stock?

Freeport-McMoRan’s Stock Price, Source: Google Finance

Troubles in Indonesia

Freeport operates the world’s second largest copper mine, the Batu Hijau mine in Indonesia. However, the company’s operations have been beset by an uncertain regulatory environment in recent months. Regulatory changes banning unprocessed mineral exports from Indonesia forced Freeport to suspend the exports of copper concentrate from its Indonesian operations. As there is a lack of smelting capacity within Indonesia, the suspension of exports translated into a reduction in the rates of processing of copper ore at Freeport’s Indonesian facilities. Though Freeport commenced mineral exports under a six-month temporary permit in April, the Indonesian government expects the company to switch from its existing long term investment agreement to a shorter term mining license, which also entails time-bound commitment for smelter construction, the payment of export duties and the divestment of 51% of the company’s stake in its Indonesian operations to Indonesian interests. [3] While the company is engaged in negotiations with the Indonesian government to ensure the continuation of its operations on more favorable terms, the uncertainty surrounding the outcome of these negotiations with the government has weighed on its stock price.

Political Deadlock in Washington

Copper prices and the stock prices of copper miners such as Freeport rose sharply post the 2016 U.S. presidential elections, buoyed by President Trump’s legislative agenda — which included his proposed $1 trillion infrastructure spending plan and the rationalization of corporate taxes. However, political turmoil surrounding the White House and a polarized U.S. Congress has stalled the implementation of President Trump’s agenda. This lack of progress on the enactment of potentially favorable legislation has contributed to the lukewarm performance of the company’s stock in recent months.

Thus, Freeport’s stock price has remained subdued in recent months as a result of the uncertainty surrounding its Indonesian operations and the lack of progress on the implementation of President Trump’s agenda. While political developments in Washington are beyond Freeport’s control, the company is working hard to address the issues surrounding its Indonesian operations. If Freeport is able to engineer a positive outcome on this front, it could substantially boost the company’s stock price.

Have more questions about Freeport-McMoRan? See the links below.

- Why Has Freeport Halted Copper Exports From Indonesia?

- Ongoing Uncertainty In Indonesia Weighs On Freeport’s Operations

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Activist Icahn reduces stake in miner Freeport-McMoRan, Reuters [↩]

- FCX SC 13 D/A Filing, SEC [↩]

- Freeport-McMoRan’s Q1 2017 10-Q, SEC [↩]