Earnings Review: Ford’s 2017 Off To A Tough Start

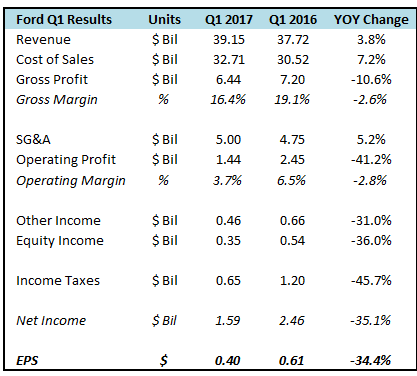

Ford Motor Company (NYSE: F) reported earnings for the first quarter of fiscal year 2017 on Thursday, April 27. The American auto maker reported a 34.4% decline in earnings per share (EPS) on the back of a 35.1% decline in net income. As we wrote in our earnings preview, Ford is expected to post lower profits in 2017, due to increased costs associated with its Super Duty pick-up trucks. Even though company-wide sales volumes were just about flat – they declined by around 1% – revenue actually increased by 3.7%, implying growth in average transaction price for the company’s products. Despite this increase in transaction prices, the company’s reported gross margin contracted by 260 basis points, with gross profit declining by 10.6% compared to the first quarter of the previous fiscal year.

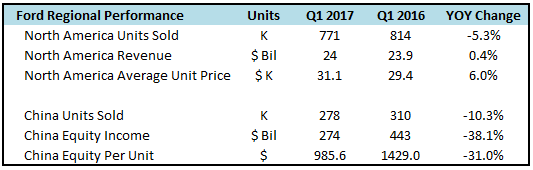

As we wrote in our preview, Ford’s sales in the U.S. declined by 4.4% over the first three months of 2017 compared to 2016 sales. Overall North America sales declined by 5.3%. However, a 6% increase in average transaction price resulted in revenue just about staying flat. In contrast, unit sales in China declined by 10.3%, with the company losing 60 basis points in market share, and its equity income from the region declined by 38.1%. This was largely the result of excess incentives to spur sales and a high presence of vehicles with engine displacement of 1.6 liters in the sales mix. Since these vehicles command relatively lower transaction prices, this resulted in equity per unit sold in China declining by 31%.

Going forward, the company is in a decent position operationally. It has a strong position in the three biggest car markets in the world, China, the U.S. and Europe, and has plans to grow its market share and profitability in each of these regions – commercial vehicles and luxury vehicle sales in China, mid-size pickups and luxury SUVs in the U.S. and controlling channel inventory in Europe. However, these might not translate into higher profits for the company since profitability might already have peaked in the auto industry. Moreover, with the industry on the cusp of significant technological and economic changes, tinkering at the margins to increase a point in market share here and a point in margins there, might not be enough to please share holders.

- With F-150 EV Production Cut 50%, What Lies Ahead For Ford Stock?

- What To Expect From Ford’s Q3 Earnings?

- Will Strong F-Series Sales Power Ford’s Q2 Results?

- Can Ford Stock Return To Its Pre-Inflation Shock Highs

- Higher Truck Sales Will Drive Ford’s Q1 Results

- Ford’s Q4 Results Were Tough, But Things Could Get Better

Have more questions about auto companies? Click on the links below:

- How Do Automotive Luxury Brands Compare In Their Performance In China?

- How Does GM’s performance vary across geographies?

- How Do Auto Luxury Brands Compare In The US?

- What Is Driving Changes In Ford’s Annual Unit Sales?

- How Much Money Does Ford Make Per Car Sold?

- How Ford’s Unit Pricing Differs Across Geographies?

- How Much Has Ford Been Investing In Growth Opportunities

- Ford’s Overwhelming Dependence On North America

- How Much Profit Does Ford Make Per Unit Sold In Each Geography?

- How Different China Growth Projections Impact Ford’s Bottomline

- How Ford’s Poor Russia Performance Is Obscuring Gains Made In Rest of Europe

- How Careful Targeting of F-Series Sales Helped Ford Boost Its Profits

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for Ford Motor

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) Get Trefis Technology