Is The Market Pricing Expedia Fairly?

Expedia (NASDAQ: EXPE) has performed strongly over the past couple of years, with nearly 23% annual growth in revenue. Expedia has managed to garner a majority of the online travel space with acquisitions and organic growth. With a target of doubling its gross booking in 2018 in comparison to the previous year and increased investments to cater to international markets, this bodes well for the company’s growth outlook. Our price estimate of $132 suggests that the market is pricing Expedia, 16% below our estimate.

We have also created an interactive dashboard which shows our forecasts and estimates for the company; you can modify the key value drivers to see how they impact the company’s revenues, bottom line, and valuation.

Steps To Arrive At Our Price Estimate

- Expedia Stock is Up 75% Since 2023. Where Is It Headed Post Q4?

- What To Expect From Expedia’s Q3 After Stock Up 8% This Year?

- Can Expedia Stock Return To Pre-Inflation Shock Highs?

- Can Expedia’s Stock Rebound After Falling 50% Over The Last Year?

- Expedia Stock To Likely See Little Movement Post Q4

- 28% Gains Left For Expedia Stock?

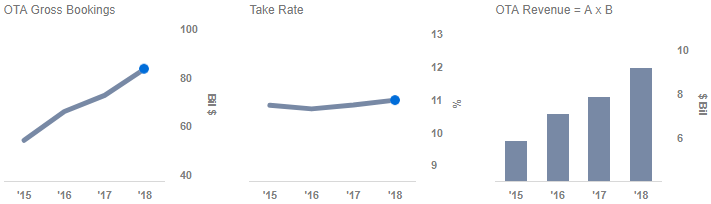

We expect Expedia’s OTA gross bookings to hit $83.6 billion in 2018. The company has witnessed increased gross bookings over the past couple of years owing to the bookings on websites such as hotels.com, hotwire.com, EAN, expedia.com, and the company’s acquisitions such as Orbitz, Travelocity, CarRentals, which have furthered its international expansion. Despite a slight decline in average daily rate, a significant growth across the nights rooms were booked led to increased revenue from lodging. Even air ticket revenues grew amid increased bookings. With a take rate of 11%, which is similar to the figure for the past few years, we estimate OTA revenue of $9.2 billion for 2018.

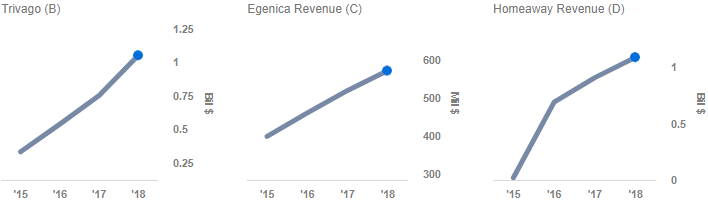

Further, we expect revenue from other sources such as Homeaway, Trivago, and Egenica, to be around $2.7 billion for 2018.. Homeaway, which was acquired by the company in December 2015, is an online marketplace for the vacation rental industry. The division has seen over 46% growth in gross bookings in 2017 with over 500,000 of its properties listed on Expedia’s platforms. We anticipate steady growth in 2018 with increased property listings. Egencia, the corporate travel arm of Expedia, is expected to grow at its historical pace. Trivago, the company’s meta-search platform has grown phenomenally over the years, thus justifying increased investment in this division.

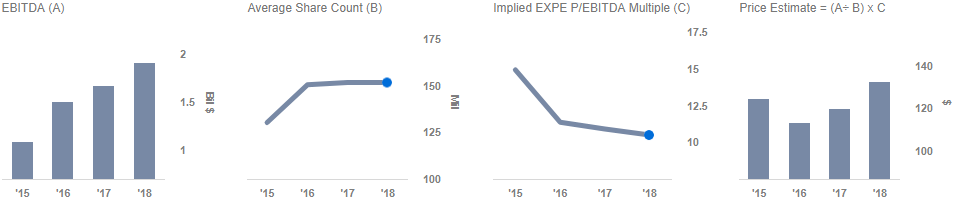

As the company realizes the costs associated with the recent acquisitions and increased investment to strengthen the technological capabilities, this could lead to a decline in margins. We expect Expedia’s EBITDA margin to decline slightly to 16%.

A revenue estimate of $11.9 billion results in EBITDA of $1.91 billion. Given the average share count of 151.6 million, this gives us EBITDA per share of $12.60. Keeping in trend with the decline over the past two years, we expect Expedia’s trailing twelve-month P/EBITDA multiple to be around 10.5 at the end of 2018, which when multiplied with expected EBITDA per share, gives us $132 as a fair price estimate.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.