EOG’s Earnings To Surge Backed By Its Focus On Premium Drilling Locations And Cost Reduction

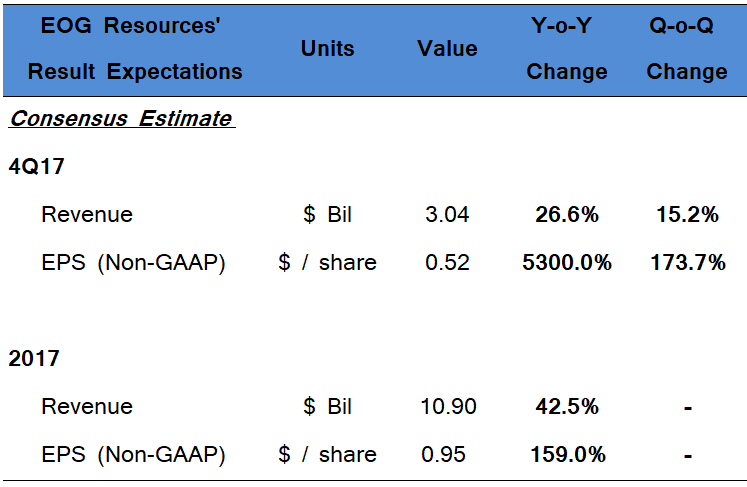

EOG Resources (NYSE:EOG), the US-based shale producer, is set to report its December quarter and full year 2017 results on 27th February 2018((EOG Resources To Announce December Quarter 2017 Results, 18th January 2018, www.eogresources.com)). The market expects the company’s top-line and earnings to show significant improvement, backed by higher volumes and better price realization. Further, the company’s low cost structure, coupled with its focus on premium drilling locations, is likely to boost its bottom-line for the quarter as well as the full year.

We have a price estimate of $107 per share for EOG Resources, which is in line with its current market price. We will revise our model shortly, based on the company’s full year 2017 results to reflect its actual numbers and future guidance.

Key Trends Witnessed In 4Q’17

- With the extension of the Organization of Petroleum Exporting Countries’ (OPEC) production cuts in the fourth quarter, commodity prices witnessed a sharp rise. The WTI crude oil prices averaged at $55.26 per barrel for the December quarter, notably higher than the $48.18 per barrel of the previous quarter. For the full year 2017, WTI oil prices stood at $50.80 per barrel, 17% higher than 2016. Thus, we expect this higher price realization to boost EOG’s revenue for the quarter as well as the full year 2017.

- Given its focus on premium drilling locations, we expect EOG to achieve its target of 20% oil production growth and 7% overall output growth for 2017. This strong improvement in the company’s production will drive its 2017 revenue growth.

- Backed by the company’s relentless efforts to reduce its completed well costs in its key plays such as the Eagle Ford, Delaware Basin, and Bakken, we expect to see a jump in its bottom-line for the quarter as well as full year.

- In the last quarter, EOG expanded its premium inventory to roughly 8,000 net drilling locations from 7,200 in the previous quarter, increasing its total premium net resource potential to 7.3 billion barrels of oil equivalent (Bn Boe). With an inventory of premium drilling locations that can last for over a decade, EOG is in a sweet spot to generate higher returns for its shareholders even in a soft price environment. We will closely watch the company’s 4Q’17 results for any update on its premium drilling locations.

Do not agree with our forecast? Create your own forecasts for EOG Resources and its 2017 performance using our interactive platform.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.