What is Estee Lauder’s Fundamental Value Based On Expected 2019 Results?

Estee Lauder (NYSE: EL) has displayed progressive growth in the last few years. In FY 2018, the company’s revenue grew by 16%, driven by meaningful organic growth in its Skin Care and Makeup segments. Estee Lauder’s Skin Care segment constituted one-third of its sales, driven by strong innovations, increasing demand from younger consumers, and gains from its hero products – Estée Lauder, La Mer, Origins, and Clinique brands. Further, EL’s makeup segment continued to see strong sales, and increase in the revenue driven by strong growth from its brands viz. Estée Lauder and Tom Ford, Too Faced, BECCA, and La Mer. Moreover, the Fragrance segment grew primarily due to double-digit gains across all geographies, and the Hair Care segment revenue rose owing to the successful launch of new Aveda products. In all, EL is focused towards its new strategies, making successful value enhancing acquisitions, and executing well on its productivity initiatives for FY 2019.

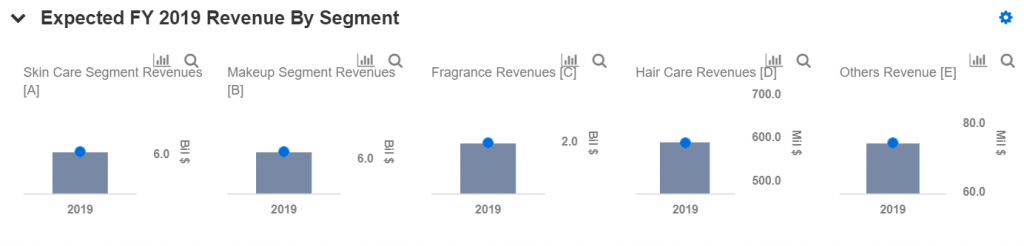

We have summarized our forecasts in an interactive model Estee Lauder’s Fundamental Value Based On Expected FY ’19 Results. You can modify assumptions such as changes in expected segment revenue or EBITDA margins to see how they impact the company’s value. The image below shows one of the key steps in identifying EL’s valuation sensitivity to changes in its segment revenues. We detail how changes in revenue or segment EBITDA margin impacts total EBITDA, which then impacts value (assuming a constant PE multiple).

- What’s Next For Estée Lauder Stock After 10% Gains Post Q2 Results?

- What’s Next For Estee Lauder Stock After A 19% Fall Yesterday?

- Will Estee Lauder Stock Rebound To Its Pre-Inflation Shock Highs?

- Cross-Sector Comparison: Is Estee Lauder A Better Pick Over LLY Stock?

- What’s Next For Estee Lauder Stock After A 17% Fall In A Month?

- Should You Buy Estee Lauder Stock After A 36% Decline Since 2021?

EL’s margins have also improved in FY 2018, with growth reported in each of its segments. Despite entering into new emerging markets, and shifting strategies, the company has ensured its structure has remained strong, and its operations have continued to be efficient. Much of the growth for EL has been a result of strong performance across all the five key segments – Skin care, Makeup, Fragrance, Hair Care, and Other Segment. Our forecasts for the year are summarized in our dashboards for Estee Lauder. If you have a different view, you can modify various inputs to see how changing inputs impacts the company’s valuation. You can share the links to scenarios created on our platform.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.