Duke, Southern, Dominion: Utility Stocks Continue To Underperform. Time To Buy?

The markets have largely recovered from the Covid-19 related sell-offs. The S&P 500 is now back to January 2020 levels, driven largely by the U.S. government stimulus. However, utility stocks have underperformed significantly, with our portfolio of 4 large-cap utilities, which includes Duke Energy (NYSE:DUK), Southern Company (NYSE:SO) and others, down by about 6% year to date. Why is this happening? Weren’t utilities supposed to be defensive bets? Also, are there any tailwinds that could turn things around for the sector? We answer some of these questions below.

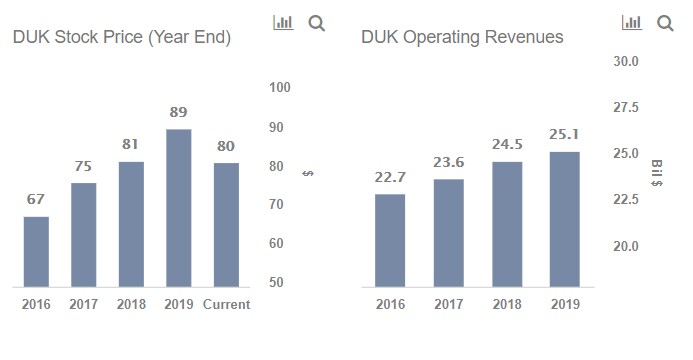

Our Utility Theme: NextEra, Duke, Dominion & Southern has more details on the historical performance and returns of the largest U.S. based utility companies.

Why Are Utility Stocks Underperforming?

- Duke Energy Jumps 10% On Takeover Rebuff News – What’s Going To Happen Now?

- Duke Energy Could Have 20% Upside. What Are The Catalysts?

- Is Ameren’s 2x Price Rise Compared To Duke Energy Justified?

- Why NextEra’s 5x Price Rise Versus Duke Energy Is Not Justified

- Duke, NextEra, Southern: Are Big Utilities Riskier Through This Downturn?

- Duke Energy & NextEra Down 20%. Which Is A Better Buy?

There are a couple of reasons for the underperformance. Firstly, there remain real concerns about electricity demand in the U.S. Per the Short-term energy outlook published by the U.S. EIA last week, electricity consumption is projected to fall by about 4.2% in 2020 versus 2019. Commercial sales are likely to decline by 7% with demand from the industrial sector likely to decline by 5.6%. This could put pressure on the revenues and profits of utility companies. [1] Secondly, investors have shown a preference for asset-light, yet relatively defensive sectors such as software and Internet services through the current downturn. Utility companies, on the other hand, have been doubling down on debt over the last few years to fund upgrades and expansion, increasing their risk profile versus previous downturns.

What Are The Catalysts For A Recovery?

However, we see a couple of tailwinds for the sector, as well. The Federal Reserve has reduced benchmark interest rates to levels of near-zero and this makes the sizable dividends of utility companies more appealing for yield-seeking investors. Separately, lower interest rates should also help utility companies reduce interest costs. With electricity demand set to rise over 2021 (1.5% growth projected by the EIA) and the Fed indicating that interest rates are likely to remain at current levels through 2022, the narrative around the sector could change over the next few quarters as there signs of a demand revival, helping the stock prices of utility companies.

While utility stocks could fare better going forward, we see these 5 large-cap stocks outperforming 5 In S&P 500 That’ll Beat The Index: TWTR, ISRG, NFLX, NOW, V

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Notes:- SHORT-TERM ENERGY OUTLOOK, U.S. EIA, July 7, 2020 [↩]