How Did Dr Pepper Snapple Perform In Its Final Quarter Before The Merger?

Dr Pepper Snapple (NYSE:DPS) released its first quarter results on April 25, wherein a growth in revenue and a drop in earnings was reported. The revenue growth was driven by higher pricing and increased volumes, besides improvement of Bai Brands. Meanwhile, higher SG&A expenses, largely a result of increased logistics costs, transaction costs related to the pending merger, and an increase in other expenses due to a rise in inflation, resulted in a drop in earnings. As a result, the company missed consensus estimates by a massive 16 cents per share. As was the case while declaring the fourth quarter 2017 results, the company did not issue a press release and host a quarterly webcast conference call, but instead filed its form 10-Q with the SEC before the market opened on April 25. A proxy filing process related to its previously announced merger transaction with Maple Parent Holdings Corp., which owns Keurig Green Mountain Inc., has been cited as the reason for this.

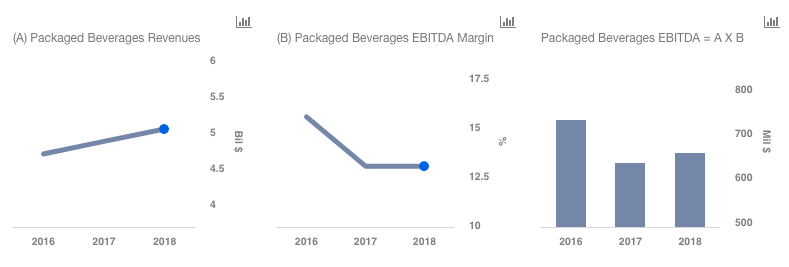

We have a $122 price estimate for Dr Pepper Snapple, which is slightly higher than the current market price. The charts have been made using our new, interactive platform. The various driver assumptions can be modified by clicking here for our interactive dashboard, to gauge their impact on the earnings and price per share metrics.

- Here’s What To Expect From Corning’s Q1

- Should You Pick Alaska Airlines Stock At $45 After Q1 Beat?

- Rising 25% Year To Date, Will Q1 Results Drive Chipotle Stock Higher?

- Visa Stock Is Up 15% In the Last 12 Months, Will The Trend Continue Post Q2 Results?

- What Should You Do With Caterpillar Stock Ahead of Q1?

- Is There Any Room For Growth In CSX Stock After An Upbeat Q1?

Trends That Positively Impacted The Quarter

1. Popularity of Ginger Ale: Canada Dry had an 8% gain in the quarter due to steady growth in the ginger ale category and product innovation. The increasing popularity of ginger ale has been driven by millennials, as they look for more authentic, quality beverages having natural flavors. Ginger beverages have been gaining traction in many markets around the world, with demand growing strongly at a 32% year over year growth rate across the U.S., U.K., Spain, and Mexico. Ginger, a sought-after flavor, was also ranked in the top 10 in Google’s 2017 Beverage Report.

2. Potential of Bai Brands: Bai Brands has tremendous potential to grow and drive DPS’ revenues going forward. As millennials move away from carbonated soft drinks, demand for healthier options is increasing, and Bai is likely to be the front-runner for DPS in terms of healthy beverage options. Moreover, from an ACV (all-commodities volume) standpoint, while there are still distribution opportunities for its enhanced water product, greater opportunities lie in other platforms, such as Bubbles, Super Tea, and Black. ACV is considered an insightful measure for soft drink companies, and can be generally thought of as “% of stores selling,” but with stores weighted based on their size, and hence, reflects the item’s exposure to consumer spending. In the quarter, Bai volumes increased 54% driven by distribution gains, product innovation, and promotional activity, while also benefiting in terms of comparison of a full quarter versus two months in Q1 2017.

3. Reduction in Effective Tax Rate: The lowering of the corporate tax rate from 35% to 21% in the U.S., effective January 1, 2018, positively impacted the company. Consequently, its effective tax rate for the first quarter of this year was 24.7%, as compared to 28.6% in Q1 2017.

See Our Complete Analysis For Dr Pepper Snapple

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.