Why Are Domo’s Valuation Multiples So Much Lower Than Alteryx’s?

After its recent IPO, Domo Technologies has attracted a lot of scrutiny as its revenues dip and sales and marketing costs skyrocket. The company’s stock price is down by nearly 15% since its first trading day and its market cap is now around $600 million, much lower than its pre-IPO valuation of nearly $2.3 billion in its last funding round in 2017 (read Domo’s $2 Billion Valuation Looks Steep Given Its Operating Metrics, Intensely Competitive Industry).

Since Domo’s IPO, we have been examining its growth trajectory, cost profile and cash flow outlook to determine a fair valuation for the company. Here we compare Domo to business intelligence competitor Alteryx in terms of key metrics in order to better determine a fair value for its stock. Our interactive dashboard analyzes these figures for both companies. You can modify any key drivers to see their impact on each company’s results and valuation.

Given the falling valuation, Domo’s stock is now trading around 4.5x its forecast revenue for 2018. Note that given the operating losses, P/E or EBITDA multiples are not practical in looking at Domo’s valuation. Meanwhile, competitor Alteryx commands a multiple of around 13.5x based on its expected revenues for 2018 and current market capitalization of around $2.4 billion.

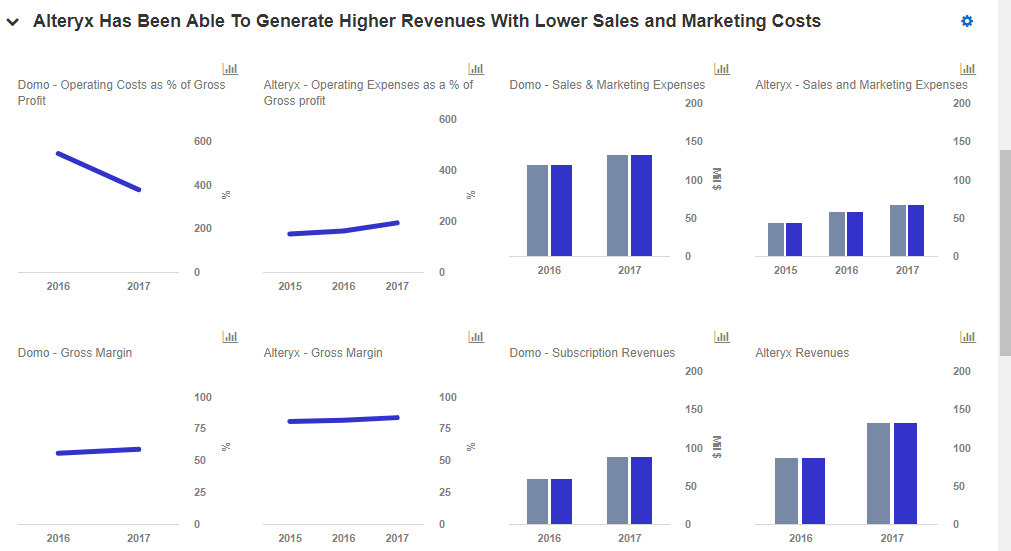

Domo’s customer acquisition costs are massive, and its operating costs as a percentage of gross profit are more than 300%. This is much higher compared to Alteryx, where the ratio is less than 200%. The below charts give a comparative analysis of Domo and Alteryx’s expenses:

Domo’s Expenses Are A Concern

From these charts it can be seen that Domo’s cost of revenues are higher (significantly lower gross margin compared to Alteryx) and the company is spending significantly more on sales and marketing. In 2017, Domo’s total revenues were $108 million, while it spent $131 million on sales and marketing – more than 100% of revenues. Alteryx, on the other hand, spent $66 million on sales and marketing to generate revenues of around $131 million in the same year – spending a much more sustainable 50% of revenues on sales and marketing.

To put the size of Domo’s sales and marketing expenses in perspective, Domo added 73 new customers in Q1 2018, with a corresponding sales spend of $39.6 million – working out to a customer acquisition cost (CAC) north of half a million dollars per customer. This kind of spending is clearly not sustainable, considering the fact that the company generated an average of $60,000 in annual subscription fees per customer over this period. That said, the fierce competition among incumbents in the rapidly-growing business intelligence industry will require Domo to continue to spend aggressively on sales and marketing expenses in the future.

It should be noted, however, that these expenses also include Domo’s annual conference, Domopalooza, which plays an important role in spreading brand awareness. The company could certainly save a lot of cash by toning down expenses on this event if need be – focusing instead on a more targeted approach to attract potential customers.

Meanwhile, Alteryx has maintained a dollar-based net revenue retention rate of around 130% between March 2016 and December 2017, indicating that it is able to generate increasing revenues from its base customers every quarter. The company has also been able to expand this strong base with more modest sales and marketing costs. Between 2016 and 2017, Alteryx added around 1000 new customers and spent $66 million on sales and marketing, which roughly works out to around $60,000 per customer.

Domo’s valuation has declined significantly and the company is commanding a very low Price/Sales multiple, most likely due to the uncertainty around its future revenue growth – given the high customer acquisition costs and cash required to incur these costs.

We forecast Domo’s revenues in 2018 to be just under $135 million, while Alteryx could generate revenues of more than $175 million. However, the Alteryx’s forward revenue multiple based on 2018 revenue forecasts is around 13.5x, compared to Domo’s forward multiple of about 4.5x. This implies concerns surrounding Domo’s high operating expenses and uncertainty around whether the company will have to raise more capital in the near term in order to fund its customer acquisition costs and drive future revenues.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own