Store Growth To Drive Dunkin’ Brands’ Growth In The First Quarter

Dunkin’ Brands (NASDAQ:DNKN) is set to announce its first quarter earnings on April 26, wherein a substantial rise in revenue and earnings is expected. This growth is set to be driven by the ambitious store count growth the company has set for itself – the company aims to add 1,000 new restaurants by 2020. During the fourth quarter of the previous financial year, the company marked its 46th consecutive quarter of positive comparable sales for the business. However, the comps rate was less than 1%, roughly the same rate the company managed for the full year. This implied that the company grew at a slower rate than its main competitors – Starbucks and McDonald’s.

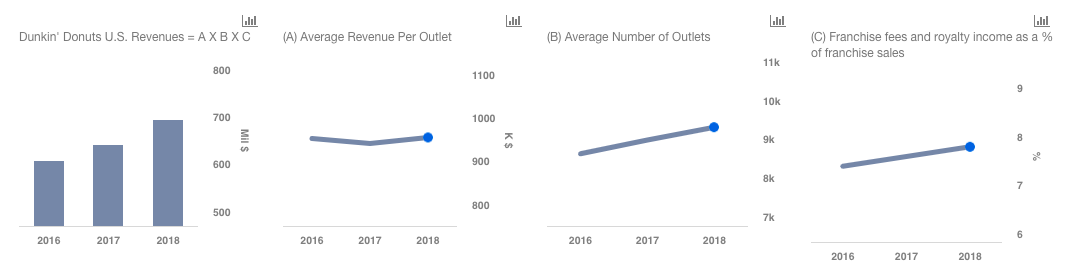

We have a $62 price estimate for Dunkin’ Brands, which is slightly higher than the current market price. The charts have been made using our new, interactive platform. You can click here to modify different drivers, and see their impact on the EPS and price estimate for the company.

- Is Dunkin’ Brands’ Stock Overvalued?

- 20% Upside For BJ’s Restaurants’ Stock When Pandemic Subsides?

- Can Dunkin’ Brands Survive A Covid Recession?

- Donuts Over Burgers: Why Dunkin’ Brands Stock Looks More Attractive Than McDonald’s

- Dunkin’ Brands Stock Looks Undervalued At $58

- Dunkin’ Brands To Meet Consensus Estimates For FY 2019?

Key Trends That Will Impact The Results

1. Positive Industry Environment: The overall restaurant industry environment has been positive for the quarter ended March 2018. While comparable traffic declined, comparable sales have been positive on the back of higher average checks. In March, same-store sales growth was 0.8 percent, the second-best month for restaurant industry sales growth over the last two years. While fine dining and upscale casual restaurants have consistently shown sales growth, casual dining and fast casual struggled heavily in 2017. This trend seems to be reversing, as this segment has shown signs of recovery this year, recording positive sales in the first quarter of 2018. This should benefit Dunkin’ Brands.

2. Menu Innovation: This includes the introduction of new beverages and new sandwiches, a focus on seasonal donut offerings around the year based on key holidays, removal of artificial dyes, and value offerings. Promotions such as sandwiches for $2 are likely to be introduced throughout the year – which should give the company a competitive edge over other players such as McDonald’s which are offering similar value deals. This can drive ticket-size for the company increasing the average revenue per outlet.

3. Convenience To Customers: Dunkin’ Brands is looking to increase the conveniences it offers to its guests with several initiatives such as a focus on its loyalty program, testing a digital catering platform, and tying up with third-party delivery options with a goal of creating a strong delivery and catering platform by the end of next year. The company is also working on building a dedicated mobile order drive-thru lane to ensure speed of service to its digital customers.

4. Expanding Its Footprint: Dunkin’ Brands is looking to expand the footprint of Dunkin’ Donuts U.S. at a 3% annual rate, adding around 1,000 new restaurants by 2020. It is also looking to convert its existing restaurants into NextGen stores to offer better customer service. New restaurants add to revenue growth, and should positively impact the company’s valuation.

See Our Complete Analysis For Dunkin’ Brands

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.