Dunkin’ Brand’s Five-Pronged Strategy Paves The Way For Future Growth

An immensely profitable, and well established brand, Dunkin’ Donuts (NASDAQ:DNKN), has recently seen a slowdown in its revenues and comps sales, especially in its international segments. This slowdown is attributable to a number of factors plaguing the world economy for the last few years, such as volatile oil prices, currency fluctuations, an uncertain interest rate environment, ambiguous minimum wage laws, and general weakness in the global macroeconomic outlook. These factors, together, have resulted in weak consumer demand and a downturn in industry-wide comps. To address these concerns, Dunkin’ publicly declared a five-pronged strategy to promote future growth.

- Dunkin’ U.S.: Increase Comparable Store Sales Growth

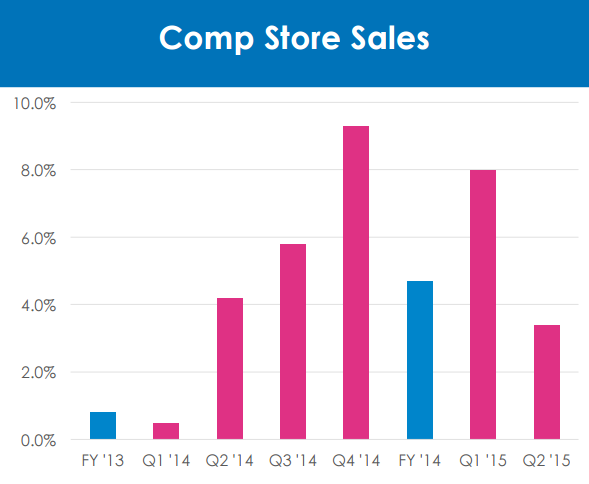

Over the past few years, Dunkin’ U.S. has consistently shown growth in its comparable store sales growth data, despite weakness in other segments. This is attributable not only to Dunkin’s strong brand value, but efforts by the company to stay relevant in the times of changing consumer tastes and preferences. To ensure the continued success of Dunkin’ U.S., the company is taking a multitude of steps.

- It decided to follow Starbucks’ footsteps and establish a stronger foothold in the coffee market through the introduction of cold brews.

- It has introduced breakfast sandwiches, and continues to innovate in its product range to offer an expanded menu.

- The company is strengthening its digital platform to drive its sales higher through targeted marketing. Further, it has also introduced mobile order and pay, following Starbucks very successful mobile ordering app.

Source: Dunkin’ Brands Second Quarter Presentation

- Is Dunkin’ Brands’ Stock Overvalued?

- 20% Upside For BJ’s Restaurants’ Stock When Pandemic Subsides?

- Can Dunkin’ Brands Survive A Covid Recession?

- Donuts Over Burgers: Why Dunkin’ Brands Stock Looks More Attractive Than McDonald’s

- Dunkin’ Brands Stock Looks Undervalued At $58

- Dunkin’ Brands To Meet Consensus Estimates For FY 2019?

Through this strategy, the company hopes to grow its U.S. comparable store sales in the range of 2%-4% in the next five years.

- Dunkin’ U.S.: Expanding Its Global Footprint

At approximately 78%, Dunkin’ U.S. accounts for the majority of the company’s revenues. Further, according to our estimates, 87% of Dunkin’ Brand’s stock value comes from this division.

In the year ended 2015, Dunkin had approximately 8,430 outlets in the U.S. alone. Since then, this count has grown ~2% to 8,573 stores.

Source: Dunkin’ Brands Second Quarter Presentation

In its recent presentation, the company said that it sees an opportunity to double its footprint in the U.S., its most profitable geographical segment, to 17,000+ outlets in the next five years. As a result, Dunkin’ hopes to achieve a 6% annual growth in net store development. Although, the move will require high capital expenditure, in the long term it will accelerate the company’s revenue growth rate.

- Dunkin’ and Baskin International: Accelerate Growth

Global uncertainty and weak macroeconomic outlook has left the international segments (Dunkin’ and Baskin-Robbins International) of the company ailing. The revenues and comparable store sales data has seen no turnaround, declining quarter after quarter. Dunkin’ Brands plans to improve discipline and profitability in international markets by focusing on standards, food safety, and identifying high profit potential markets.

Source: Dunkin’ Brands Second Quarter Presentation

Internationally, Dunkin’ has presence in Asia, Middle-East, Europe, and Australia. Taking a step further to expand its presence internationally, it entered an agreement to open and operate more than 1,400 stores in China, over the next twenty years. We believe China will be the next big growth market for the company, driving its revenues higher. As of now the international segments, together, account for a meager 10% of the company’s valuation, according to our estimates.

- Baskin Robbins U.S.: Comparable Store Sales Growth, Store Growth

Baskin U.S.’ contribution to the company’s total revenue has been deteriorating over the last five years. However, owing to its initiatives such as Warm Cookie Ice Cream Sandwiches, the company saw 0.6% comps growth in Baskin U.S. in Q2, 2016. Dunkin’ hopes to open 5-10 new Baskin outlets in the U.S., to drive its comp sales growth to 1%-3% in 2016.

Moreover, to adapt to the ongoing trends in the QSR industry, it plans to launch 16 new ice cream flavors, and introduce more Greek yogurt flavors as well.

Dunkin’s franchise model is one of the most high margin businesses in the industry, at over 60% operating profit margin. The company hopes to leverage its existing model to attract new franchises by offering lucrative offers. This, in turn, will likely result in faster growth in the revenue stream.

- Consumer Packaged Goods: Enhance Brand Relevance

Consumer Packaged Goods (CPG) is increasingly gaining an important role as a part of the core business for coffee sellers like Starbucks and Dunkin’. The fast-paced change in eating/drinking trends has resulted in a greater dependency on non-core streams like CPG. Only yesterday, CPG was an ancillary business line for Dunkin’, while now it hopes to pave its way towards future growth by expanding its outreach within the segment. Following are the steps it has undertaken to grow the brand awareness of its consumer packaged goods:

- Dunkin’ sold more than 300 million K-cups in its first year of launching, resulting in $200 million of the $500 million revenues earned through CPG in 2015. It hopes to continue gaining market share by expanding its advertising budget and competing with rivals like Starbucks and McDonald’s in this area.

- Expanding distribution of pints and freezer bars.

- Establishing the position of its DD Bagged Coffee and Creamers by enhancing awareness for at-home customers.

Have more questions on Dunkin’ Brands (DNKN)? See the links below.

- Breakfast Sandwiches, Coffee Sales Lead Dunkin’ To Profitability In Q2’16, Even As The International Segments Suffer

- Dunkin’ Brands’ Q2 FY’16 Earnings Preview: Product And Digital Innovation To Support Earnings

- Dunkin’ Brands To Enjoy Robust Revenue Growth In 2016, Despite International Segments Struggling in First Quarter

- What Is Dunkin’ Brands’ Revenue & EBITDA Breakdown?

- By What Percentage Have Dunkin’ Brands’ Revenues And EBITDA Grown Over The Last Five Years?

- How Has Dunkin’ Brands’ Revenue And EBITDA Composition Changed Over 2011-2015?

- Where Will Dunkin’ Brands’ Revenue And EBITDA Growth Come From Over The Next Three Years?

- Dunkin’ Brands’ FY 2015 Earnings Review: Dunkin’ Donuts US & K-Cups Drive Revenue Growth, Baskin-Robbins International Struggles

- Dunkin’ Brands’ Q1 FY’16 Earnings Preview: All Eyes On Comp Sales Growth Of International Segments

- What’s Dunkin’ Brands’ Fundamental Value Based On Expected 2016 Results? (Updated After Q1 2016 )

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)