What Lies Ahead For Deere After Strong Q3 Results?

Deere (NYSE:DE) announced its fiscal Q3’18 earnings on August 17, reporting a massive 32% increase in net revenues to slightly over $10.3 billion. Agriculture and Turf revenue was up 18% y-o-y to under $6.3 billion while Construction and Forestry revenue nearly doubled to slightly under $3 billion. Deere’s Agriculture and Turf revenues have soared as a result of robust replacement demand for large agricultural equipment, increased investment by farmers into upgrading their crop spraying equipment, and a recovery in commodity prices. Comparatively, the Construction and Forestry segment saw robust revenue growth in recent quarters, largely due to the contribution from Wirtgen, coupled with increased investment in oil & gas, transportation, and housing. Going forward we expect this trend to continue through the end of the current year.

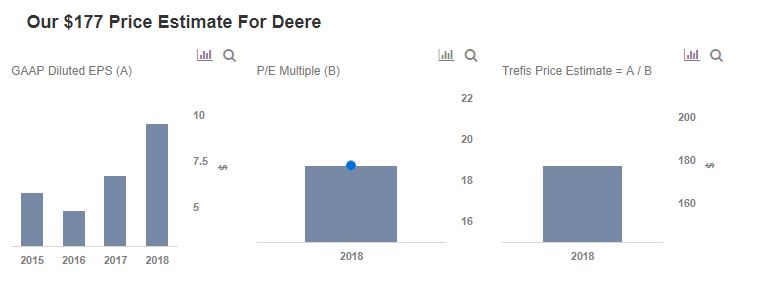

We expect continued global tailwinds – increased global food consumption and higher population density that will drive a greater need for infrastructure development – to drive these results. We have summarized our expectations and forecasts for FY’18 results on our interactive results forecast dashboard for Deere. If you think differently, you can change expected segment revenue and margin figures for Deere to gauge how it will impact the company’s results for fiscal year 2018.

- Should You Pick Deere Stock At $360 After 6% Fall In A Week Amid Downbeat Outlook?

- Down 4% This Week What’s Next For Deere Stock After Downbeat 2024 Guidance?

- Should You Pick Deere Stock At $380 Ahead of Its Q4 Results?

- Are Capital Equipment Stocks Like Deere Worth Buying Despite Rising Interest Rates?

- Should You Buy Deere Stock After A 10% Fall In A Week Despite Solid Q3?

- Is Deere Stock A Better Pick Over KO?

Outlook For FY’18 And Beyond

The Agriculture and Turf segment enjoyed a strong first three quarters of 2018, as margins improved as a result of a recovery in commodity prices and a favorable sales mix. Deere expects further improvement in the Agriculture segment, as a result of agricultural mechanization in developing countries and increased demand for food due to a rising population. This should result in strong order activity – increased replacement demand and demand for new equipment. Further, its most recent acquisition of Blue River Technology should help farmers reduce costs by decreasing the use of herbicides, which could lead to increased demand for its crop spraying equipment and provide decent long-term benefits. In addition, the acquisition of King Agro should help farmers improve productivity, which should further increase the demand for its spraying equipment. Moreover, the acquisition of PLA should fuel Deere’s commitment to providing cost-effective equipment, technology, and services to farmers, which should help farmers improve productivity. The acquisition further expands Deere’s market position in Latin America. We expect a positive outlook for Deere in the near term, driven by improving conditions of the agriculture market, and increased global food consumption, which will likely spur demand for its agriculture products.

The Construction Industry segment saw robust growth in the first three quarters of 2018, as a result of increased investment in oil & gas, housing, and transportation coupled with contribution from Wirtgen. Construction spending is projected to remain strong in 2018, due to the strengthening of the U.S. economy, which should boost the U.S. Housing market and construction spending. This growth, coupled with the Wirtgen acquisition, should boost Deere’s Construction business in the coming years. The implementation of tariffs on steel and aluminum will no doubt increase the costs for Deere’s Construction Industry segment, which is heavily reliant on steel. Moreover, the increase in raw material costs as a result of the steel tariffs should result in a hike in prices of the goods manufactured by Deere.

See our complete analysis for Deere

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own