Fed Rejects Deutsche Bank’s Capital Plan; Goldman, Morgan Stanley and State Street Receive Conditional Approval

The Federal Reserve cleared the capital return plans of 34 of the 35 bank holding companies (BHCs) that were a part of this year’s stress test for banks, with Deutsche Bank’s U.S. subsidiary (DB USA) failing to make the cut this time around on qualitative grounds. While Deutsche Bank had successfully made it through the stress test last year, the Fed rejected its 2018 capital plan due to “material weakness in its capital planning” – something it had done in 2015 and 2016 as well.

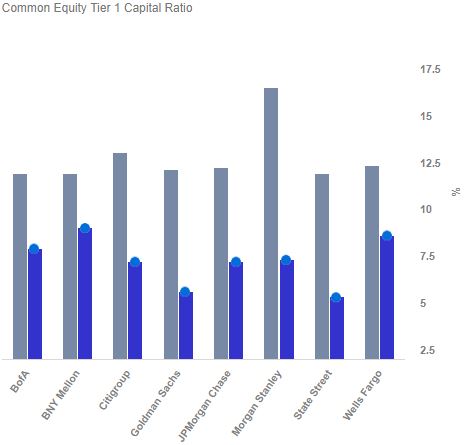

Additionally, Goldman Sachs and Morgan Stanley only received conditional approval for their capital plans due to the sharp reduction in their capital ratio figures under the test scenario – something we summarized last week in our interactive dashboard for participating banks. These investment banking giants will have to limit their 2018 capital distribution plans to the same level they had over the last four quarters. The Fed also found State Street’s counterparty risk to be concentrated – although the custody bank’s increased capital plan was cleared by the Fed with the condition that it manage its counterparty exposure better.

Notably, this year’s stress test results are worse than those from 2017, when the Fed cleared the capital plans of all 34 BHCs involved, with only one bank (Capital One) receiving a conditional approval. The reason for this is the stricter test scenario considered by the Fed for the current stress test cycle. That said, all of these U.S. banks are extremely well-capitalized, and are much better prepared to weather a downturn than they were before the 2008 recession.

As has been the trend in recent years, the Fed’s acceptance of the banks’ capital plans for the year was followed by a string of press releases by these firms announcing dividend hikes, share buybacks or both late on Thursday, June 28.

Why Does The Federal Reserve Have A Say In The Capital Plans For U.S. Banks?

The banking sector has traditionally attracted investors looking for dividends. However, in the aftermath of the global economic downturn of 2008, the banks had to cut their dividends to shore up capital – which makes sense considering the number of banks that went under during that period. It was only after the stress test in 2012 that the banking giants could finally begin paying back shareholders for their patience. And payout ratios for the largest U.S. banks are gradually returning to the high levels seen just before the downturn.

However, the Fed has kept an eye on the capital return plans of U.S. banks as a part of the stress tests. The stress tests aim to gauge the strength of each of the country’s largest financial institutions under conditions similar to those seen during the economic downturn of 2008, and they help the Fed advise individual firms about how much they need to shore up their balance sheets if necessary. The Fed, therefore, includes the bank’s plan for a year (which includes dividend hikes, share repurchases, and mergers and acquisitions and more) as a part of the stress test to ensure that none of these actions have an adverse impact on a bank’s capital reserves.

As seen above, Goldman Sachs, Morgan Stanley and State Street witnessed the steepest reduction in their core common equity tier 1 (CET1) capital ratios (more than 6 percentage points) in the quantitative round of the stress test under the severely adverse scenario. Goldman and Morgan Stanley also saw a sharp decline in their supplemental leverage ratios under the test – with this key ratio falling below the minimum requirement of 3% if their capital return plans for this year were also factored in. This is what led to the Fed restricting their payouts for this year. On the other hand, State Street’s comparatively conservative capital return plan allowed it to clear the Fed’s hurdle.

What Does The Fed’s Approval Mean For The Banks?

Banks that cleared the Fed’s regulatory hurdle unconditionally are free to boost their dividends and to repurchase shares as long as the total amount is in line with what they submitted to the Fed. And nearly all the banks have detailed their intention to boost payouts in individual statements. As for Deutsche Bank, the stress test failure does not directly impact the capital plan of the Germany-based parent company, although the bank is expected to fix the inadequacies in its capital planning process.

We will detail the proposed capital payout plan by individual banks in subsequent notes, while also explaining the impact of a dividend hike and/or share repurchase on their share prices.

You can compare changes in CET1 ratios for these banks under the severely adverse as well as adverse scenarios in more detail on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own