Delta’s Q4 Earnings Come In Strong, Revenues Show Incremental Growth.

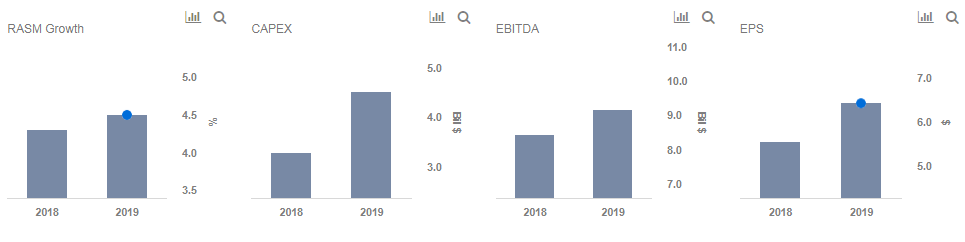

Delta Air Lines (NYSE: DAL) has seen incremental growth in 2018, with RASM growing by 4.3% for the year, and 3.2% for the quarter. Net income came in at $1.02 billion in the fourth quarter. This is up from $299 million in the previous year. Per share earnings were up 42% compared to last year coming in at $1.30. Operating revenue came in 8% higher at $10.7 billion. Overall 2018 saw a 20% rise in earnings per share. Full year revenue came in at $44 billion, Delta continued to be a top performer in terms of service among all major American airlines. It should be noted that Delta’s earnings improved partially due to a reduction in taxes for the quarter. Adding to that, Delta was also able to recover most of the $2 billion in fuel costs that it faced for the year.

Our price estimate for Delta is $62 per share, which is higher than its market price. View our interactive dashboard for Delta 4Q 2018 and modify the key drivers to visualize the impact on the company’s price.

Delta has continued to see incremental gains on both the domestic and international front. With domestic revenues coming in 7.7% higher and international revenues growing by 4.8%. Delta should see improved traffic flow in the first quarter of 2019, this despite the shutdown. While Delta has guided lower, early trends show bookings should be strong in the first quarter.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

Delta’s focus on cargo saw revenues come in 16% higher while, maintenance repair, and overhaul (MRO), saw revenues rise by 19%. Its premium category saw a 10% rise for the quarter, and Delta added 4% additional capacity to the premium space. With costs growing by 1.4% for the year, helped Delta achieve its target of staying below 2% cost growth. For the year pre-tax margins were in line coming in at 7.1%. Delta believes it can push up those margins in the coming year.

A significant contributor to the increase in margins and capacity in the coming year will be how Delta allocates its capital expenditure spend. Delta expects to allocate $4.5 billion to capital spending in 2019, mostly as a result of replacing most of its narrow body fleet. This should help improve Delta’s efficiency.

Overall, the company continues to show incremental improvement quarter on quarter. While we don’t expect earnings per share to rise at the pace they did last year, one could see Delta’s earnings rise by 10-12% in 2019. Overall, Delta is solid as an airline company, and the stock will likely see some upside if it performs well in the coming quarters.