Delta Earnings Preview: Tax Cut To Benefit Earnings, While Revenues Jump On Higher Demand

Delta Air Lines (NYSE:DAL) has performed quite well over the last year, beating the consensus estimates comfortably in the last three of four quarters. In general, we expect this momentum to continue into 2018, as well. The improving economy, and consequently, heavier demand, should help drive top line growth through most of the financial year. That said, we expect the company’s bottom line to be hurt on increased energy and wage costs.

Delta is the first of its competitors to post earnings in any given quarter. This, for better or for worse, makes the company a sort of a bellwether for the entire airline sector.

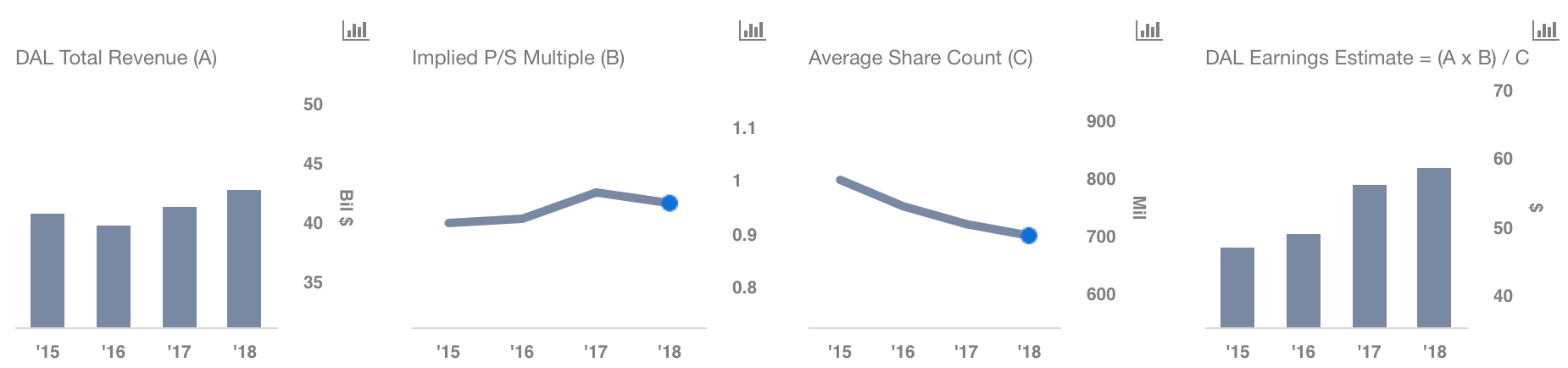

Since the beginning of the year, the company’s value has declined by about 5%. That said, we believe the current price to be undervalued by about 8%. In this respect, we have created an interactive dashboard analysis to estimate Delta’s valuation based on its expected revenue for FY 2018. Click on the link to modify the figures to arrive at your own price estimate.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

Better Economy To Propel Demand

The economy has improved significantly in the recent past. This has consequently led to higher travel demand, which in turn, has bolstered demand for air travel. In this respect, we expect to see the company post better top line figures in the coming quarters. That said, pricing pressures on an overall increase in industry-wide capacity, may partially offset this growth.

For the upcoming quarter, we expect the company to post good unit revenue figures. For Q1, the company expects to report total revenue per available seat mile, or TRASM, to increase to the tune of approximately 5%, or to the higher end of its previously stated guidance range of between 4%-5%. This upside, apart from increased demand, has been fueled by higher yields per passenger.

Rising Oil Prices To Hurt Earnings

As mentioned previously, the company is expected to benefit from additional demand as the overall economy begins to recover. That said, rising energy costs are expected to hurt the bottom line significantly going forward. Oil prices have been on a rise through most of last year. As of now, Brent Crude is trading at around $69 a barrel, up significantly from the same period last year.

Airline companies rely heavily on oil for obvious reasons. In general, an increase in oil prices leads to an almost an immediate fall in profits. To put this into perspective, let’s take a look at Delta’s earnings. The company’s earnings, barring one time benefits and expenses, have grown by about 12% per annum over the last five years. That said, this growth is slowing as oil prices increase. In this respect, we now expect the earnings to increase by only about 7-9% a year over the next five years.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.