Is The Market Pricing Delta Fairly?

Like many of its competitors, Delta Air Lines (NYSE:DAL) witnessed good earnings growth in the first half of 2017, while recording a slowdown in earnings in the second half. A lethal combination of increased pricing pressures and flight cancellations due to the hurricanes were the main reasons behind this. In both Q3 and Q4, EPS was hit significantly. That said, the management was quick to react to the problem, and are expected to steer the company back on track to return to strong earnings growth by early 2018. In this respect, barring the short term volatility, the company’s stock price increased throughout the year, ending the year considerably higher than at the beginning.

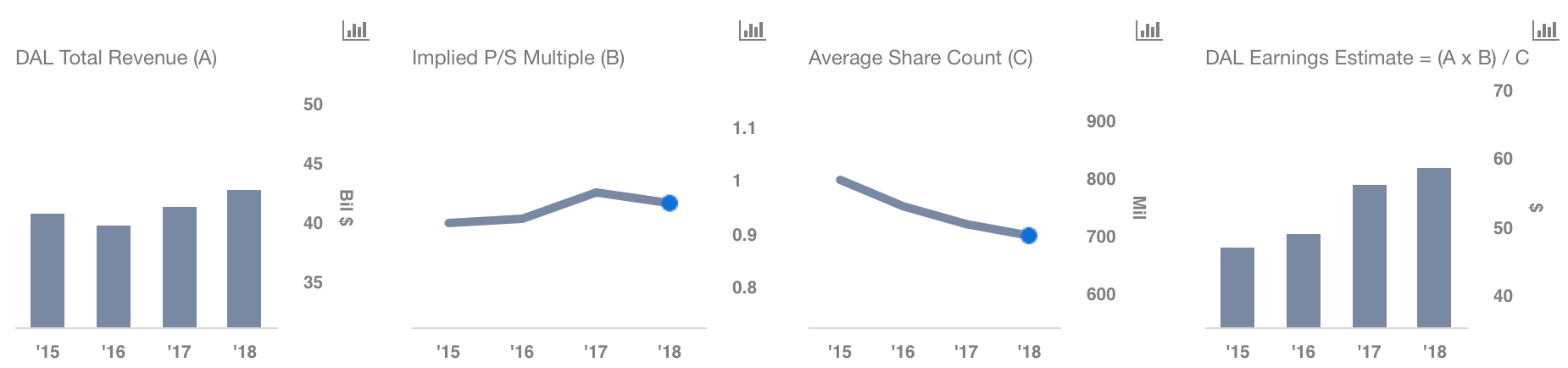

However, according to our calculations, the stock is still undervalued by about 8%. We believe the fair price to be around $59. In this respect, we have created an interactive dashboard analysis to estimate Delta’s valuation based on its expected revenue for FY 2018. Click on the link to modify the figures to arrive at your own price estimate.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

In general, Delta derives its revenues from four sources – Mainline, Regional, Cargo, and Other. While Cargo revenues are expected to increase positively, we believe that Mainline, Regional, and Other segments are going to be the primary revenue drivers.

Revenues at Mainline and Regional are expected to grow on the back of increased air travel demand. In fact, the company expects unit revenues on its international routes to improve at a faster pace than at its domestic routes, which may bear the brunt of increased pricing pressures.

The primary component of Other revenue is fees from reservation changes and excess baggage fees charged to customers. Understandably, this does not account for much of the total sales. However, with increased passenger miles, revenues in the division are bound to increase in a similar proportion. We expect to see Other revenues jump to about $6 billion in FY 2018.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.