Key Takeaways From Delta’s Q4 Earnings

Delta Air Lines (NYSE:DAL) reported a rather strong earnings, to finish off the year, last week. After posting a rather mixed Q3, the company managed to bring things back to speed this time around. Revenues and earnings per share in the quarter jumped significantly at 8.3% and 17.1%, respectively. Additionally, the company managed to post its most notable unit revenue growth figure in 2017. The key metric jumped to 4.4% in Q4. This uptick enabled Delta to post a solid profit despite facing significant cost headwinds.

The company expects this to just be the beginning. In 2018, it forecasts that EPS would reach $6.35 to $6.70, up about 30% year over year.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

Revenues Revive Across The Spectrum

Over much of the last three years, like its competitors, Delta Air Lines has witnessed unit revenues in many of its international routes erode. The sudden fall in the oil prices, the strengthening dollar, global economic weakness, and pricing pressures were the main contributing factors to this trend. That said, international unit revenue jumped by almost 5% in the latest quarter, growing quicker than its domestic unit revenue. In that respect, the company has managed to post positive unit revenues in every region of the world this time around.

Of all the markets Delta operates in, the trans-Pacific market remained its weakest for over five years. While the growth in the region continued to lag overall, the company managed to post a significantly improved growth of 1.6% in unit revenues here. Meanwhile, unit revenues in all its other markets saw better-than-expected growth this time. Unit revenue rose by about 3.5% domestically, while the key metric saw increases of about 7.4% on transatlantic routes, and 4% in Latin America.

This comes as great news, as a balanced performance is more likely to be sustainable than unit revenue growth driven by just one or two regions. Delta hopes this strategy will allow unit revenues to continue performing with a similar momentum in 2018 as well.

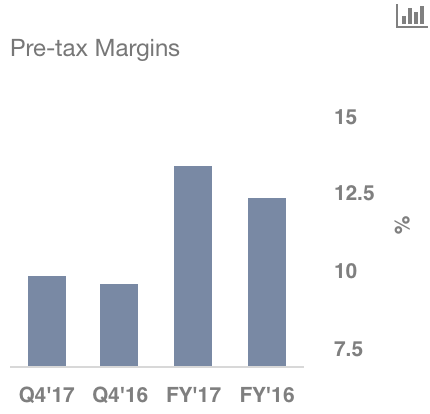

Profits Could See A Jump Going Forward

Delta’s profit gains in 2017 were largely offset by higher non-fuel cost growth. The company’s non-fuel CASM increased by a notable 4.3% for the full year. That said, it appears as though costs will dissipate in the coming months. The airline expects the March quarter to be its peak cost growth of the year, with unit costs jumping by about 2-4%. Through the second half of the year, non-fuel expense growth is expected to come down dramatically. In this respect, for the full year, the company hopes to achieve 0-2% non-fuel CASM growth. Here’s why:

- The company will lap the costs that it began incurring last year with a 6% April employee pay increase.

- Depreciation is expected to come down significantly in the second half of the year. To make sense of this, depreciation for the full year is expected to be up by about $250 million, with almost 80% of that increase coming in the first half of the year alone.

- Additionally, maintenance expenses are also weighted towards the first half of the year as the company gears up for summer flying and certain aircraft extensions, driven by the result of delays and deliveries of the C Series.

Further, at the latest investor day, the company announced that a reduction in the statutory corporate tax rate, from 35% to a much lower 20%, is expected to boost the estimate EPS figure by close to $1-1.25. The statutory rate has been set at 21%, so Delta will get most of that projected savings.

The charts above have been created using Trefis dashboards.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap