Delta Q3’16 Earnings Review: Continued Headwinds In Unit Revenues, Despite Reduction In Capacity

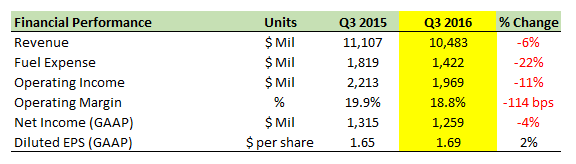

Delta Air Lines (NYSE:DAL) released its September 2016 financial results on 14th October 2016, beating the consensus for earnings, while slightly missing it for revenue. The company attributes the decline in revenues primarily to the strength in the U.S. dollar compared to other currencies, and the technology outage that occurred in early August. However, due to fiscal discipline and the continued slump in oil prices, the company was able to deliver operating margins almost comparable to Q3, 2015, at 18.8%.

In terms of providing value to the shareholders, the $1.1 billion free cash flow (adjusted for capital expenditure and hedging activities) allowed the company to return approximately $650 million back to its equity owners, in terms of dividends and buybacks. This, in turn, helped buoy earnings upwards, despite a decline in revenues.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

Although Delta’s unit revenues for Q3’16 came in line with its guidance range of -7%, the downtrend was seen to be persistent, despite minimal capacity growth in the quarter. The only region to show positive unit revenues was Latin America, mainly due to the launch of new flights to Mexico and Cuba. It seems unlikely that the airline will be able to turn around its PRASM numbers at the end of this year, as it earlier expected, due to the supply and demand imbalances in the Atlantic region and China, and the impact of foreign currency fluctuations. In line with this, the revised guidance for the fourth quarter unit revenues is in the (3%) – (5%) range. The company hopes to curtail the capacity growth in the remainder of the year and throughout the next year to 1%-2%, as it tries to return to positive PRASM in the face of rising oil prices and margin deterioration.

In terms of expenses, the company expects non-fuel costs to increase slightly in the quarter, due to lower capacity and expenses on maintenance. Consequently, Delta expects its operating margins to decline on an annual basis to 14%-16% in Q4’16. Further, in 2017, these costs may increase as the impact of the pilot agreement and higher fuel costs begins to be felt on operating expenses.

Have more questions about Delta Air Lines (NYSE:DAL)? See the links below:

- How Did Delta Perform Operationally In August?

- What Is The Impact Of Flight Delays?

- Delta Versus JetBlue: Expansion Into Boston And Its Effect On Unit Revenues

- How Will Delta Air Lines Utilize Its Cash Flows?

- Delta Airlines Re-Fleeting Program: How Will It Help?

- Why Has Trefis Lowered Delta’s Price Estimate From $51 To $44 Per Share?

- Delta Q2’16 Earnings Preview: Rising Oil Prices, Lower Unit Revenues May Drag Down Revenues

- Delta Continues To Face Headwinds In Revenues, But Delivers On Earnings Growth in Q2’16

- Delta’s Profits Continue To Surge As Crude Oil Prices Remain Low In 1Q’16

- What Should We Expect From Delta’s 1Q’16 Results?

- How Did The Legacy Carriers Perform Operationally In January?

- Why Did Delta’s Operating Margin Soar In 2015?

- Delta Air Lines: The Year 2015 In Review

- How Will Delta’s Revenue And EBITDA Grow Between 2015 and 2018?

- How Has Delta’s Revenue And EBITDA Changed Over The Last Five Years

- What Is Delta’s Revenue And EBITDA Brekdown?