Higher Production And Price Realizations To Drive Chevron’s 4Q’17 Results

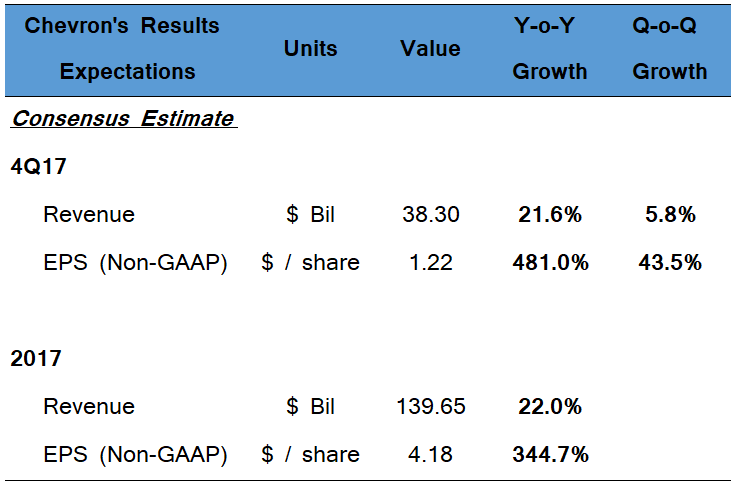

Chevron (NYSE:CVX), one of the world’s largest integrated energy companies, is slated to release its December quarter and full year 2017 financial performance on 2nd February 2018((Chevron To Announce December Quarter 2017 Results, www.chevron.com)), the same day Exxon Mobil (NYSE:XOM), its closest competitor, announces its results for the quarter. Similar to the last quarter, the market expects the company to post a solid improvement in its earnings, backed by higher production growth and improved price realization. Further, the company’s relentless efforts to control its operating costs and capital spending are likely to bolster its bottom-line for the quarter as well as the full year. We currently have a price estimate of $118 per share for the company, which is lower than its market price.

See Our Complete Analysis For Chevron Here

Key Trends Witnessed In 4Q’17

- The extension of the Organization of Petroleum Exporting Countries’ (OPEC) production cuts in the fourth quarter led to a sharp rise in commodity prices during the quarter. The WTI crude oil prices averaged at $55.26 per barrel for the December quarter, notably higher than the $48.18 per barrel of the previous quarter. For the full year 2017, WTI oil prices stood at $50.80 per barrel, 17% higher than 2016. Thus, we expect this higher price realization to boost Chevron’s upstream revenue for the quarter as well as full year 2017.

- In terms of production, Chevron expects its 2017 output to grow between 6%-8% (excluding asset sales). For 2018 and beyond, the company expects to expand its production at a steady rate driven by its robust pipeline of projects that are likely to add roughly 2,150 thousand barrels of oil equivalent per day (MBOED) of additional production capacity over the next 3-4 years.

- Year-to-date, Chevron has completed assets sales of $4.9 billion, which is likely to enhance its cost structure, while allowing it to manage its cash flows to meet its capital spending and debt repayment needs. These asset sales have not only proved to be accretive to the company’s operating profits, but also allows it to focus on only shorter-cycle and high return investments.

- Chevron has made significant headway in bringing down its operational costs by improving the operational efficiency of its existing assets through the use of data analytics and advanced drilling technologies. We expect Chevron to realize notable cost savings in this quarter, which will boost its earnings.

- Lastly, the oil and gas producer has restricted its capital spending budget to $19.0-$19.8 billion for 2017 and to around $17-$22 billion for the remaining years of this decade, concentrated on the ramp up of its Gorgon LNG and Wheatstone LNG Projects in Australia, and shale and tight rock drilling activity in the Permian Basin. A lower capital investment will allow the company to focus at enhancing the results from its high-margin assets, while managing its cash flows to bring down its debt obligations in the coming quarters.

You can create your own forecast for Chevron using our interactive platform.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap