What Is Chevron’s Operational Strategy For 2018? – Part 2

Depressed commodity prices over the last three years have severely impacted the profitability of oil and gas companies worldwide, throwing a number of them out of business. However, companies that continue to hold high-quality assets, and an experienced management, have been able to weather the current commodity slump efficiently and are likely to emerge undefeated from this downturn. Chevron (NYSE:CVX) is one such integrated energy company, based in the US, that not only held a firm ground during the commodity slump, but has emerged much stronger from it. In our previous analysis – What Is Chevron’s Operational Strategy For 2018? – Part 1 – we had talked about the company’s production plans for the next few years. In this note, we aim to discuss the cost reduction measures undertaken by the company to sustain its operating margins, even in the weak price environment.

We have a price estimate of $118 per share for Chevron, which is in line its current market price.

See Our Complete Analysis For Chevron Here

- Up 9% Year To Date, Will Chevron’s Gains Continue Following Q1 Results?

- Down 18% Since 2023, How Will CVX Stock Trend Post Q4 Results?

- Down 13% This Year Will Chevron Stock Rebound After Its Q3?

- What To Expect From Chevron’s Stock Post Q2?

- Chevron Stock Down 13% Over Six Months, What’s Next?

- Chevron’s Q4 Earnings: What Are We Watching?

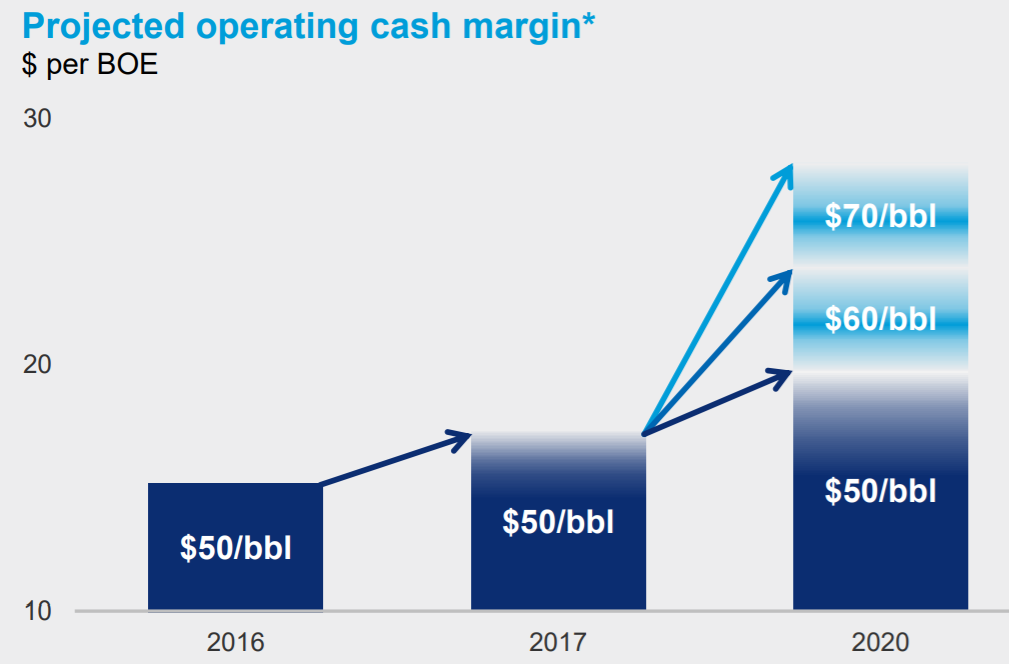

Source: Chevron’s Investor Presentation, November 2017

As a byproduct of the commodity downturn, many oil and gas companies have optimized their cost structures in order to sustain their profitability. On similar line, Chevron has made significant headway in bringing down its operational costs over the last couple of years. The company managed to reduce its operating costs from roughly $30 billion in 2014 to $25 billion in 2016, a decline of almost 16% in two years. To achieve this, the oil and gas company has worked consistently to improve the operational efficiency of its existing assets through the use of data analytics and advanced drilling technologies. The graph below depicts Chevron’s estimated output from its Permian assets versus the actual production. The actual production from these assets has been higher-than-expected so far due to the efficiency gains realized from the use of the aforementioned techniques.

Source: Chevron’s Investor Presentation, November 2017

In addition to the use of the latest technologies, Chevron has been streamlining its upstream portfolio to improve its profitability. For this, the company has been divesting its non-core and/or low-margins assets in order to enhance its margins. These asset sales have not only proved to be accretive to the company’s operating profits, but also allows it to focus on only shorter-cycle and high return investments. Year-to-date, Chevron has completed assets sales of $4.9 billion, which is likely to enhance its cost structure, while allowing it to manage its cash flows to meet its capital spending and debt repayment needs.

Going forward too, Chevron aims to keep a check on its operating costs in 2018 and beyond, which will boost its margins in an improving price environment. Accordingly, we expect the company’s profits to rebound to pre-2014 levels over the next few years, assuming that these cost reduction initiatives are successfully implemented and are accompanied by a steady recovery in the commodity markets. Below, we present our forecast of Chevron’s EBITDA over the next few years. Feel free to create your own scenarios and visualize their impact on the company’s stock price using our interactive platform.

Chevron’s EBITDA Estimates (2017-2021)

Also stay tuned for our Part 3 of this series, where we will discuss how the company aims to bring down its rising long term debt in the coming years.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap