What Is Chevron’s Operational Strategy For 2018? – Part 1

Chevron (NYSE:CVX) is among the few oil and gas companies that have held their ground despite the turmoil in the commodity markets in the last three years. Though the oil giant lost almost 45% of its value in 2015 due to the plummeting commodity prices, it has gradually regained its lost value over the last two years driven by the rebound in commodity prices. We believe that Chevron’s strong project pipeline, coupled with management’s efforts to reduce its operating costs and maintain liquidity, will provide a notable upside for the company in the coming years. In this series of articles, we will discuss the company’s operational strategy to deal with the ongoing commodity slump in 2018 and beyond. We start with talking about the company’s production strategy for 2018.

See Our Complete Analysis For Chevron Here

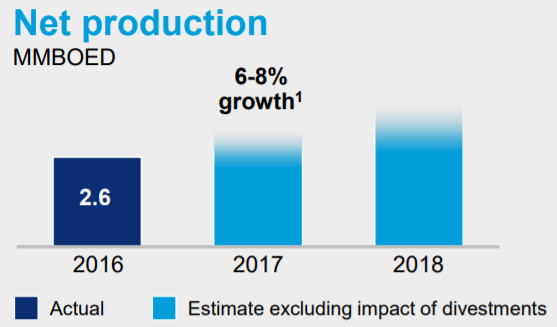

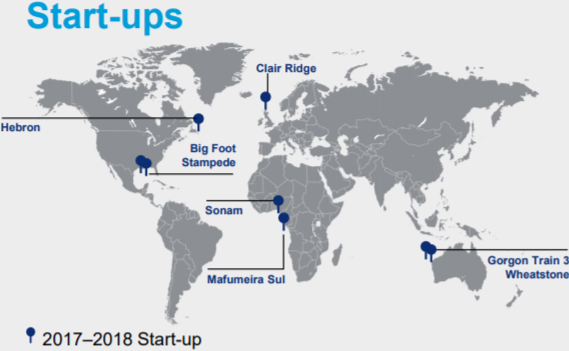

With the extension of the Organization of Petroleum Exporting Countries’ (OPEC) production cuts until the end of 2018, the outlook for the commodity markets has improved significantly. The global benchmark for crude oil prices, Brent, has averaged at around $54 per barrel year-to-date, indicating a sustained recovery in the coming quarters. This has encouraged large oil and gas players to expand their production budgets for the next few years to leverage the anticipated recovery in the commodity prices and recoup their lost money. However, unlike its competitors, Chevron plans to grow its output at 6%-8% (excluding asset sales) in 2017 and at a steady rate in the remaining years of this decade. The company has a robust pipeline of projects that are likely to add roughly 2,150 thousand barrels of oil equivalent per day (MBOED) of production capacity to its existing capacity over the next 3-4 years. Of these projects, more than 80% are either operational or are expected to come on-stream in 2017-2018.

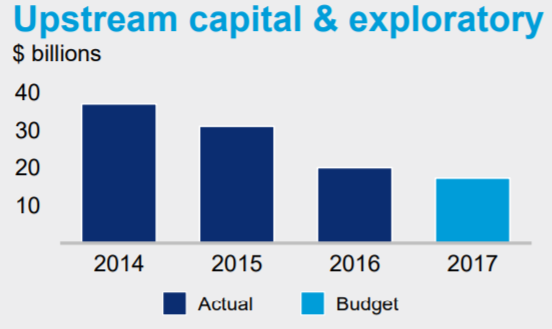

While Chevron focus on ramping up its oil and gas operations, particularly the Gorgon LNG and Wheatstone LNG Projects in Australia, and shale and tight rock drilling activity in the Permian Basin, it aims to reduce the capital investment in its upstream operations. This implies that the company plans to maximize the output from its existing assets by utilizing advanced technologies, and invest lower capital into these assets. A higher production will ensure that the company can leverage the anticipated recovery in commodity prices in the coming years, while a lower capital spend will allow the company to manage its cash flows better and enhance its shareholder returns over time.

Below we present our estimates for Chevron’s upstream production growth and capital expenditure over the next few years. You can create your own scenarios about the company’s upstream performance and visualize its impact on the company’s stock price using our interactive platform.

Stay tuned for our Part-2 of this series, where we will discuss how the company aims to sustain its profitability in the coming years.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap