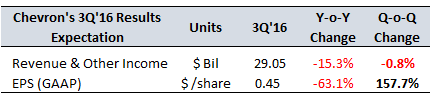

Chevron 3Q’16 Earnings To Be Higher Than The Last Quarter Owing To Improved Commodity Prices

Chevron (NYSE:CVX), one of the world’s largest integrated energy companies, is likely to report an improvement in its September quarter earnings on 28th October 2016, [1] backed by its consistent cost reduction efforts and notable recovery in commodity markets. Though the oil and gas company’s top line could remain depressed due to lower production, its bottom line is expected to improve, as lower-than-expected refining margins and one-time charges for asset sales and impairment charges are unlikely to be booked in this quarter.

While the commodity prices continued to be much lower compared to the last year, natural gas prices showed early signs of recovery in the quarter. Henry Hub natural gas prices, a global benchmark for gas prices, increased almost 35% in the third quarter, while crude oil prices remained flat during the same period. Since Chevron drives relatively lower value from its natural gas operations than its liquids production, the recovery in gas prices may not translate into a sizeable growth in its revenue for the quarter.

Source: US Energy Information Administration (EIA)

That said, Chevron has been rigorously working towards improving its operational efficiency in order to sustain its margins in the current downturn. In the first half of 2016, the US-based company managed to bring down its operating costs by close to 8% on a year-on-year basis. Based on the company’s latest investor presentation, it aims to further curb its operating costs at the same rate and restrict these costs to less than $10 billion in the second half of the year. These cost savings are likely to trickle down to the company’s pre-tax operating income and lead to a notable improvement in the company’s earnings in this quarter.

Source: Chevron’s 2Q’16 Presentation

Apart from this, Chevron is focused on streamlining its portfolio, while deriving the fair value from its non-core and non-strategic assets. In this regard, the company expects to complete asset sales of $5-$10 billion in between 2016 and 2017. Further, the company aims to utilize the proceeds of these divestitures to fund its capital requirements. For the full year 2016, the integrated company targets to spend $25-$28 billion, which could vary depending on the recovery of commodity prices. For the following two years, the company will keep its capital spending between $17 billion and $22 billion, subject to maintaining a cash balanced position. This will allow the company to maintain and grow its dividend and remain competitive in the industry.

Have more questions about Chevron (NYSE:CVX)? See the links below:

- How Will Chevron’s Revenue Move If Crude Oil Prices Rebound To $100 Per Barrel By 2018?

- How Will Chevron’s Revenue Move If Crude Oil Prices Average At $50 Per Barrel Until 2018?

- Is LNG The Next Big Thing For Oil And Gas Companies?

- Chevron’s 2Q’16 Earnings To Be Severely Hit Due To Persistently Low Commodity Prices

- What’s Chevron’s Revenue & Earnings Breakdown In Terms of Different Products?

- What’s Chevron’s Fundamental Value Based On Expected 2016 Results?

- What Has Led To More Than 30% Decline In Chevron’s Revenues & EBITDA In The Last Five Years?

- How Has Chevron’s Revenue Composition Changed In The Last Five Years?

- By What Percentage Can Chevron’s Revenues Grow Over the Next Five Years?

- Why Crude Oil & NGLs Operations are 3x As Valuable As Refined Products Operations For Chevron?

Notes:

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

- Chevron To Announces Its Third Quarter 2016 Results, www.chevron.com [↩]