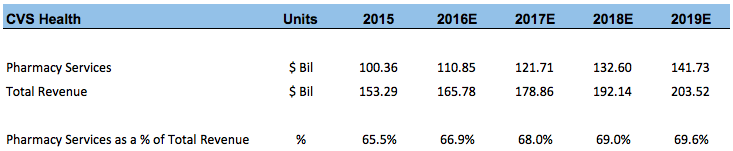

Why Pharmacy Services Will Drive CVS’ Growth Going Forward

CVS (NYSE:CVS), the market leader in the retail pharmacy sector, has consistently strengthened its offerings in recent years, particularly with its acquisition of Omnicare and Target’s pharmacy division. The acquisition of Omnicare has helped CVS strengthen its already booming Pharmacy Services division. Going forward, we expect the Pharmacy Services division to grow at a faster pace than the company’s other divisions, driven by an aging population and growing spending on specialty drugs.

CVS has gradually transformed into a well-rounded healthcare company, with a presence in pharmacy benefit management (PBM) and retail clinics. The company’s Pharmacy Services division caters to all age groups with its PBM offerings. The addition of Omnicare, with its special long term care (LTC) plans, has boosted the company’s ability to dispense prescriptions in facilities serving the senior patient population, which is expected to grow significantly in the near future. The U.S. population aged 65 and over is projected to increase to more than 56 million by 2020. [1]. This will lead to a significant increase in the number of prescriptions filled. CVS, with more than 9,600 stores in the country, is best placed to benefit from this expanding demographic.

Specialty drugs – which target a narrow group of largely chronic diseases, and are generally fairly costly – constitute over 30% of total prescription spending in the U.S., despite only accounting for around 1% of total prescriptions filled. ((Specialty Pharmaceuticals, February 1 2016)). Specialty drug spending is expected to grow from $98 billion in 2015 to $212 billion by 2020, which represents a solid opportunity for CVS. [2]. Omincare’s specialty programs, in addition to CVS’ existing programs – Pharmacy Advisor and Specialty Connect – provide it a platform to make the most of this opportunity.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- Profile of Older Americans: 2015 [↩]

- Specialty Pharmacy Revenues, Drug Channels, April 21 2016 [↩]