Could The Demise Of CSX’s CEO Be Another Reason For Its Downfall?

The year 2017 has not been a great one for the US-based railroad company, CSX Corporation (NASDAQ:CSX). The company gained momentum early-on in the year from the appointment of E. Hunter Harrison, a railroad industry veteran, as the Chief Executive Officer (CEO). However, despite the rebound in the coal and metal shipments, the company could not sustain its operational performance and ended up losing some of its market share to its peers. To top this, just when the company had started to deliver on Harrison’s Precision Scheduled Railroading (PSR) model, the news of his sad demise over the last weekend hit the markets, leaving the company in a predicament. CSX’s stock had dropped almost 8% last week after the company announced that Mr. Harrison would take some time off his duties to recuperate from a severe medical condition. While the stock has recovered somewhat over the last couple of days, investors continue to doubt the company’s ability to successfully implement Harrison’s PSR model. Below, we discuss the implications of Harrison’s death on the company and its ability to enhance its value in the near term.

Source: Yahoo Finance

Harrison & His PSR Model

- What’s Next For CSX Stock After A 12% Rise Last Year?

- What Next For CSX Stock After A 19% Fall In Q3 Earnings?

- Should You Pick Humana Over CSX Stock For The Next Three Years?

- CSX’s Top Line To Decline In Q2?

- Will CSX Stock Recover To Its Pre-Inflation Shock Level?

- Here’s What To Expect From CSX’s Q1

E. Hunter Harrison, who died at the age of 73, was one of the most respected US railroad specialists, and was renowned for his ability to turn around the lackluster performance of freight railroad companies. In his career of over five decades, he had reformed two of Canada’s largest railroad companies – Canadian Pacific Railway Ltd. and Canadian National Railway, before joining CSX in March of this year. During his career, Hunter had designed a successful strategy called “Precision Scheduled Railroading Model,” which is largely aimed at enhancing the operational efficiency of the railroad companies, by minimizing their car dwelling time, reducing car classifications, and balancing train movements by direction.

Source: Cowen & Company Global Transportation Conference, CSX’s Presentation

Harrison’s Successor

Soon after Harrison took over the helm of CSX earlier this year, he tried to implement his PSR model at the company. While the transformational reforms initially caused unrest at the company, resulting in a severe drop in its operational performance in the third quarter of this year (Read: Deteriorating Operating Performance Could Hamper CSX’s Market Value), things began to change over the last couple of months, as the industry veteran trained more and more personnel at the company about his model and its implications. Further, before leaving for his medical leave last week, Hunter had named James Foote, who joined CSX a couple of months back, as an interim CEO for CSX in his absence. However, with Harrison’s death, Foote will be acting as the company’s CEO going forward.

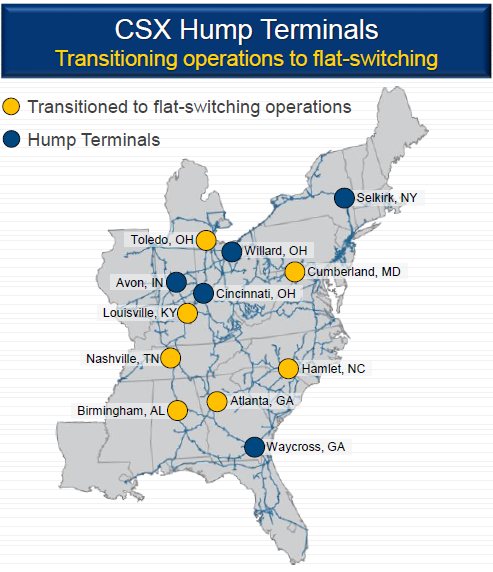

Foote, who was promoted to the position of Chief Operating Officer (COO) and Chief Sales and Marketing Officer (CSMO) last month after executives quit the company, will continue to hold the positions alongside the CEO title. He has roughly 40 years of experience in the railroad industry and had assisted Harrison in the turn around of Canadian National Railway a few years back. However, this is the first time that Foote would be heading a major railroad company and leading its transformation process. Consequently, the market has been skeptical about his ability to deliver on Harrison’s ambitious targets that included closure and/or sale of several rail yards and short-line rail segments. Mr. Foote, on the contrary, appears confident about the role entrusted upon him and aims to remain focused and follow the business plan of moving away from intermodal terminals, as laid down by the late Hunter Harrison.

Our Take

With the sudden death of CEO Harrison, the investors have been anxious about CSX’s future prospects and its ability to emerge from the ongoing troubles. To add to this, the departure of two of the top executives last month has left the company with a relatively new leadership, which raises further questions on its ability to implement Harrison’s PSR model to transform itself into a leading railroad company. However, we believe that while Harrison’s departure is a strong setback for CSX, the CEO had ensured that the company is on track to achieve new heights in the near future. Not only had he trained several personnel about his model and its effectiveness, he had also found his successor, who is well-equipped to see the company through these difficult times.

In addition to this, the railroad industry has witnessed a strong rebound over the last few quarters. For instance, the coal and metal shipments have surged since the beginning of 2017 due to the implementation of favorable business policies by the Trump government, which will augment the growth in the company’s revenues. Further, the improving oil prices are likely to enhance the fuel surcharge fees, which will further boost the company’s top-line in the coming quarters. Thus, if the company can adopt Harrison’s PSR model into its existing system, it should be able to generate higher value for its shareholders in the near term.

See Our Complete Analysis For CSX Corporation Here

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap