How Are Cisco’s Revenues Likely To Trend Over Coming Years?

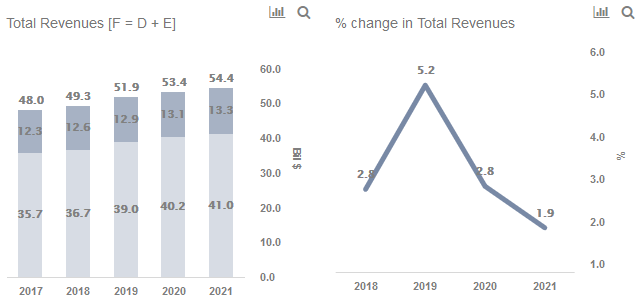

Cisco’s (NASDAQ:CSCO) stock lost a sizable chunk of its value last month after its management cautioned investors about the impact of a slowing global macro environment on its business. The news accompanied a weaker-than-expected performance by the company for its fiscal fourth quarter (ending July). Trefis highlights trends in Cisco’s revenue over recent years along with our forecast for the next two years in an interactive dashboard. We believe that the company’s revenues will grow at an annual rate of just 2% over coming years to reach $54 billion for fiscal 2021.

That said, we believe that Cisco’s stance around the weakness in the demand environment could lowball expectations when the company reports Q1 given the fact that the company’s business model is increasingly geared towards software. We maintain a fair value estimate of $52 per share for Cisco which is slightly ahead of the current market price.

A Quick Overview of Cisco’s Business Model

- Down 6% In Last 3 Months, Will Cisco Stock See A Recovery Following Q2 Results?

- Why Is Cisco Buying Splunk?

- Why The Digital Infra Theme Continues To Outperform

- What To Expect As Cisco Publishes Q3 Earnings?

- Cisco Stock Looks Like A Buy At $52

- Here’s Why Cisco Systems Stock Has Returned Just 9% Since Late 2018

What Need Does It Serve?

Cisco makes money by selling networking and communications equipment and software that are the backbone of the Internet.

Has 4 Operating Segments

- Infrastructure Platforms: Revenues are derived from the sale of core networking technologies of switching, routing, data center products, and wireless.

- Applications: Revenues are derived from the sale of software-oriented offerings that sit on top of Infrastructure Platforms, such as collaboration (Cisco TelePresence etc) and internet of things (IoT) and analytics software.

- Security and Other products: Revenues are derived from the sale of threat detection, management and security products and cloud and system management tools. This segment also used to house the company’s Service Provider Video Software and Solutions (SPVSS) business, which was hived off in 2018.

- Services: Revenues are derived from providing technical consulting and support services.

The first three divisions together constitute Cisco’s Product business.

What Are The Alternatives?

Due to the convergence in network, computing and security technologies, Cisco’s traditional competitor base of pure-play network equipment providers has expanded to from Juniper, F5 Networks and Arista to VMware, Symantec, Akamai etc.

Cisco’s 2 divisions (1) Products and (2) Services are expected to contribute roughly $40 bn (75%) and $13 bn (25%), $9 bn (11.9%) in 2020 revenue, respectively.

2020E Revenue Breakdown:

- Product revenue = 75%

- Infrastructure Platforms revenue = 58%

- Collaboration revenue = 12%

- Network Security & Other Products revenue = 6%

- Services revenue = 25%

Cisco’s revenue grew at 4% annually over 2017-19 to $52 billion and is expected to grow at a little over 2% over 2020-21 to reach $54 billion

- Product Division Revenue growth of about $2 billion over the next two years will be driven by growing need for digital collaboration and associated security.

- Services Division Revenues to grow by about $400 million over the next two years due to an increase in support work due to the increase of software components in Cisco’s overall product mix.

Actual historical and forecast figures for Cisco’s revenues are available in our detailed interactive dashboard for the company.

Like our charts? Explore example interactive dashboards and create your own.