Cisco’s Product Sales Remain Subdued

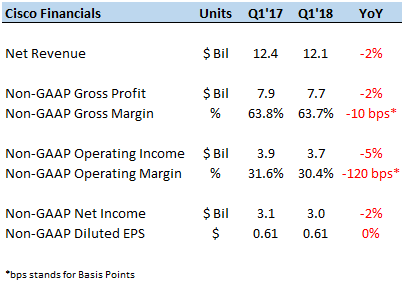

Cisco (NASDAQ:CSCO) announced its Q1 fiscal year 2018 earnings on November 15, reporting a 2% decline in revenues to $12.1 billion. The decline in revenues was attributable to weakness across product segments, particularly the core switching and routing revenue streams. On the other hand, Cisco’s collaboration segment (renamed to Applications) and security segment continued to perform well. Cisco’s gross margin (non-GAAP) for the quarter stood at 63.7%, which was around 10 basis points lower than the prior year quarter. Pricing pressure for hardware as well as services primarily drove product margins lower.

The company also reported a 5% decline in operating income (non-GAAP) leading to a 120 basis point fall in operating margin, as shown above. Resulting net income was down 2% on a y-o-y basis, with diluted earnings per share remaining flat over the prior year period at $0.61 per share for the quarter.

- Down 6% In Last 3 Months, Will Cisco Stock See A Recovery Following Q2 Results?

- Why Is Cisco Buying Splunk?

- Why The Digital Infra Theme Continues To Outperform

- What To Expect As Cisco Publishes Q3 Earnings?

- Cisco Stock Looks Like A Buy At $52

- Here’s Why Cisco Systems Stock Has Returned Just 9% Since Late 2018

We have a $33 price estimate for Cisco’s stock, which is in line with the current market price.

See our full analysis of Cisco

Performance By Segment

Cisco has reported little or no growth in core product revenues in recent years, driven by pricing pressure on hardware and a shift of consumer preferences from standalone hardware products. This trend has been evident this year, with low single digit revenue declines across most product streams. As shown below, Infrastructure Platforms (comprising of routers, switches and wireless equipment) revenues fell 4% y-o-y to just under $7 billion for the quarter.

Comparatively, applications (collaboration and unified communications) and network security solutions sold by Cisco have performed well in recent years. These segments reported mid to high single digit revenue growth, as shown below. Moreover, service-based revenues have also grown at a steady pace to offset the stagnating revenues from hardware sales. As shown below, network security revenues as well as services revenues were also up during the quarter.

In recent quarters, market leader Cisco has demonstrated strength in the network security domain. The company added around 6,000 new customers in this space in the previous quarter, which was over three times its nearest competitor. Cisco now has over 80,000 customers for its network security solutions. Cisco’s management expects this trend to continue through 2018 as well.

In terms of profits, Cisco reported a 260 basis point decline in gross profit margin (GAAP), which was largely due to weakness in the product division. Product gross margin (GAAP) was down by over 3 percentage points, which the company attributed to higher memory pricing in recent quarters. This is expected to continue in the near term.

Improved Guidance For Second Quarter

Cisco’s management gave improved guidance for the fiscal second quarter, with revenues expected to rise by around 2% to $11.8 billion. Cisco expects its non-GAAP gross margin to be around 63% for the quarter, which is over a percentage point lower than the second quarter of FY 2017. However, disciplined expense management could help improve the operating profit margin. Cisco expects its operating profit margin to be flat over the year-ago period at 30%. Resulting non-GAAP diluted earnings per share are expected to increase by around 4% on a y-o-y basis to 59 cents a share.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research