Why Cisco Is Worth Nearly 15 Times More Than Juniper

Juniper Networks (NYSE:JNPR) has traditionally been Cisco’s (NASDAQ:CSCO) key competitor in the networking space over the years. Both companies compete in selling networking equipment such as Ethernet switches, routers and network security products. Although both companies are comparable in some of these market segments, Juniper is significantly smaller than Cisco in terms of market cap and revenues. Cisco’s market capitalization of almost $160 billion dwarfs Juniper’s current market cap of just under $11 billion. Our $33 price estimate for Cisco’s stock implies a valuation of $163 billion while our $29 price estimate for Juniper implies a valuation of $11.1 billion.

As shown below, the total revenues generated by Cisco ($49 billion) stood at around 10 times Juniper’s net revenues ($5 billion) for calendar year 2016. Similarly, the reported gross profit for Cisco ($31 billion) was also around 10 times higher than Juniper’s gross profit ($3.2 billion) in the same period, with both companies reporting a similar gross profit margin. In addition, Cisco’s adjusted EBITDA stood at $14.5 billion, which was also around 10x of Juniper’s adjusted EBITDA at $1.4 billion. In this article, we take a look at how these two companies compare in terms of their main businesses, and why Cisco’s 15x valuation compared to Juniper is justified.

- Down 6% In Last 3 Months, Will Cisco Stock See A Recovery Following Q2 Results?

- Why Is Cisco Buying Splunk?

- Why The Digital Infra Theme Continues To Outperform

- What To Expect As Cisco Publishes Q3 Earnings?

- Cisco Stock Looks Like A Buy At $52

- Here’s Why Cisco Systems Stock Has Returned Just 9% Since Late 2018

Cisco & Juniper In Global Router Market

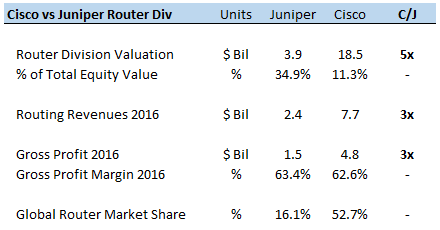

The global router market has grown steadily at low single digits over the last few years. The total router market, including service provider routers and enterprise routers, increased from $12 billion in 2010 to an estimated $14.6 billion in 2016, a compound annual growth rate of over 3%. In the router space, Cisco has been the dominant player, commanding a nearly 53% share in the market in 2016. However, Cisco has faced competition from smaller players such as Juniper, Huawei and Hewlett-Packard Enterprise (NYSE:HPE) over the years, due to which its share in the market has declined from well over 60% in 2011 and 2012 to 52.7% in 2016.

Comparatively, Juniper’s share in the global routers market has hovered around the 16-17% mark over the last few years. The key growth geographies in the router market in recent years have been Asia Pacific and Japan, while North America, Europe and Latin America have largely struggled.

According to our estimates, Cisco’s router division makes up over 11% of the company’s total value while Juniper’s router segment makes up almost 35% of the company’s total value.

Ethernet Switch Market: Cisco & Juniper

According to IDC, worldwide Ethernet switches sales increased from $18.9 billion in 2011 to $24.2 billion through 2016 at a CAGR of 5%. In recent quarters, 10GbE, 40GbE and other high performance switches were key growth drivers for the market, reporting growth in unit shipments as well as revenues. Comparatively, sales and unit shipments for 1GbE switches continued to decline. Cisco is the market leader in this market as well, with a share of over 59% in 2016. However, Cisco’s share has fallen from over 75% in 2011 to under 60% in 2016, with routing revenues hovering in the $14-15 billion range over the last few years.

Comparatively, Juniper has a significantly lower presence in this market, with only a 3.5% market share in 2016. However, Juniper’s router market share has increased from just about 2% in 2010 to 3.5% in 2016. In the same period, its switching revenues grew from around $380 million in 2010 to $860 million in 2016, a CAGR of almost 15%. This trend has continued in 2017 thus far, with Juniper reporting a 38% growth in switching revenues to $242 million for the March quarter.

According to our estimates, Cisco’s switches division makes up over 21% of the company’s total value, while Juniper’s router division makes up around 16% of the company’s value.

Network Security, Services & Other Domains

In terms of network security domain, Cisco reported $2.1 billion in revenues in 2016, which was over 6 times higher than the $320 million reported by Juniper. The segment gross profit in the same period for both was also roughly in the same proportion – $1.3 billion for Cisco and $202 million for Juniper. However, Cisco’s segment valuation stands at 16 times Juniper’s segment valuation, according to our estimates.

This difference is primarily attributable to Juniper consistently losing sales to Cisco in this market segment. Over the last few years, Juniper’s network security revenues have steadily dropped from $750 million in 2010 to under $320 million in 2016, an annual decline of over 13%. Juniper’s management attributed this decline to the company transitioning from legacy security products to new offerings and expects the declining trend to continue in the near future.

In the same period, Cisco’s security revenues have risen at over 8% a year from $1.3 billion in 2010 to $2.1 billion in 2016. This trend is expected to continue, with Cisco expected to continue to improve its security product portfolio and gain share in the market.

Cisco generated $12.3 billion in revenues from services, which was around a third of product sales. Comparatively, Juniper’s services revenues totaled $1.5 billion last year, which was over 40% of product sales. This indicates that Juniper’s customer base was slightly more willing to spend on post-sale services and maintenance than Cisco’s customers.

Cisco’s services segment is worth $35 billion, or nearly 22% of the company’s total value according to our estimates. This is roughly 11 times more valuable than Juniper’s services segment, with an estimated valuation of $3.2 billion.

Switching, Security Are The Differentiators

While Cisco and Juniper match up relatively evenly in the router segment, Cisco is far ahead in the switching segment. Moreover, Cisco has a clear edge in terms of network security solutions and network services. Cisco also has a strong market presence in certain market domains in which Juniper is not present, such as enterprise WLAN hardware, Collaboration software suites, data center products and service provider video, with each of them being a multi-billion dollar segment by value. In addition, Cisco’s cash net of debt on its balance sheet (around $36 billion) is significantly higher than Juniper’s net cash balance at around $1.8 billion. As a result, Cisco’s total valuation is around 15 times more than Juniper’s total valuation, per our estimates, as shown below.

You can modify the interactive charts in this article to gauge how changes in individual drivers for Cisco and Juniper can have on our price estimates for these companies.

See our complete analysis for Cisco and Juniper

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research