International Wealth Management Drives Credit Suisse To Record Profits In Q1

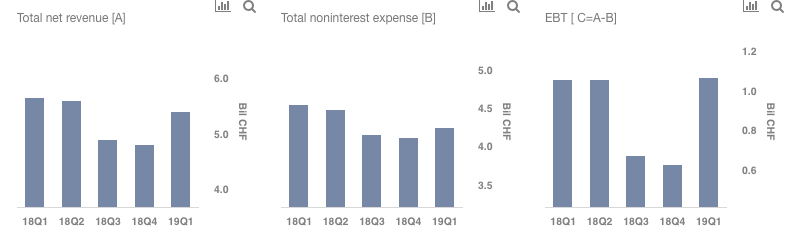

Credit Suisse (NYSE: CS) released its Q1 2019 results on April 24, its first reporting period following the completion of its three-year restructuring plan. The company reported net income attributable to shareholders of CHF 749 million, the highest quarterly profit since Q3 2015. Credit Suisse recorded revenues of CHF 5.38 billion, marking sequential growth of 12.2%. The bank handily beat Trefis’ revenue expectations of CHF 5.2 billion. Higher revenue was mainly driven by strong performance of its international wealth management division and a better-than-expected performance of its global equity sales and trading desk. The bank’s adjusted EPS came in line with our estimates of CHF 0.29, an increase of 12% from the prior year quarter. Higher earnings were primarily a reflection of stronger revenue growth, lower non-interest expense and a lower effective tax rate.

We have summarized our key expectations for the bank’s full year in our interactive dashboard – How Did Credit Suisse Fare in Q1 And What Is the Outlook for Full Year? In addition, here is more Trefis Financial Services Data.

- What To Expect From Credit Suisse Stock?

- What To Expect From Credit Suisse Stock?

- Where Is Credit Suisse Stock Headed?

- Credit Suisse Stock Missed The Street Expectations In Q3, What To Expect?

- Is Credit Suisse Stock Attractive At The Current Levels?

- Credit Suisse Stock Lost 21% Last Week, What’s Next?

Key Takeaways From Q1 Earnings

International Wealth Management Business Continues To Thrive

- Despite a challenging macroeconomic environment, CS’ international wealth management (IWM) division’s revenue grew by 4% sequentially to CHF 1.4 billion primarily driven by net new money inflows (NNA). NNA totaled CHF 1.3 billion for the quarter, with solid growth in the high net worth segment as well as a recovery of inflows in Europe slightly offset by lower flows in the UHNW segment in emerging markets.

- IWM recorded its highest pre-tax income of CHF 523 million since 2015, with return on regulatory capital of 35% while its net margin improved to 45% as operating expenses declined by 4%, reflecting continued diligent cost management.

- Total assets under management grew by 6% sequentially to reach a record high of CHF 1.43 trillion, driven by strong inflows in international markets. Moreover, management indicated that while geopolitical and macroeconomic concerns remain, their impact has begun to recede with client confidence returning progressively, and they have a strong pipeline of transactions across the wealth management division. Taking all this into account, we believe IWM will continue to drive growth for the bank in the foreseeable future.

Global Markets (GM) Posts Better Than Expected Performance

- GM achieved pre-tax income of $283 million and a return on regulatory capital of 9%, reflecting continued improving operating leverage amid challenging market conditions.

- However, net revenues decreased by 10% compared to the first quarter of 2018, driven by less favorable market conditions across its equity and debt underwriting businesses, partially offset by higher trading revenues, particularly in International Trading Solutions.

- Equity trading revenues grew by 48% sequentially to $571 million, driven by strong performance in equity derivatives, despite lower market volatility and reduced market activity.

Investment Banking Division Continues To Struggle

- Credit Suisse’s IB division reported a pre-tax loss of $94 million for the first quarter of 2019 in a challenging operating environment, compared to pre-tax income of $62 million over the same quarter in 2018, while net revenues were down 36% year on year at $357 million driven by lower market activity.

- Equity underwriting revenues were down 47% year over year, adversely impacted by investor concerns over slowing GDP and the uncertain geopolitical environment across major markets.

- Going forward, we expect the IB division to return to profitability as market activity increases and client confidence rebounds. Moreover, management stated that for Q2 the division has a solid pipeline of large announced transactions across advisory and underwriting, which should further aid growth.

Full Year Outlook

- For the full year, we expect the bank’s revenues to grow by 6% to CHF 22.2 billion, driven by growth in the bank’s wealth management division and improved performance of the IB division.

- Net margin is expected to improve from 9.8% in 2018 to 17% in 2019. This can be primarily attributed to strong revenue growth, improving operating leverage and a lower effective tax rate.

- We expect Credit Suisse’s adjusted EPS for full-year 2019 to be around CHF 1.48. Using this figure with our estimated forward P/E ratio of 11, this works out to a price estimate of $16 for Credit Suisse’s shares (assuming a CHF-USD exchange rate of 1).

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.